Today? Another matter entirely:

A Red Ocean. A sea of well-funded, savvy competitors battling to become the best of the best.

Imagine for a second that your product or company wanted to be one of these AI-adjacent champions. (‘Cause, you know, “AI” gotta be in everything now apparently.)

How would you enter, take over, and dominate the “AI tools” category?

This “AI tools” topic analysis will provide you with a blueprint. And the same underlying methodical approach can (and should) be applied to any competitive market.

So let’s get into it.

This “AI tools” topic analysis examined 47,129 keywords across 98 term groups.

A term group is typically dozens (if not hundreds or thousands) of related keywords around a central “AI tool”-related theme in this case.

There are five key questions this analysis is designed to answer:

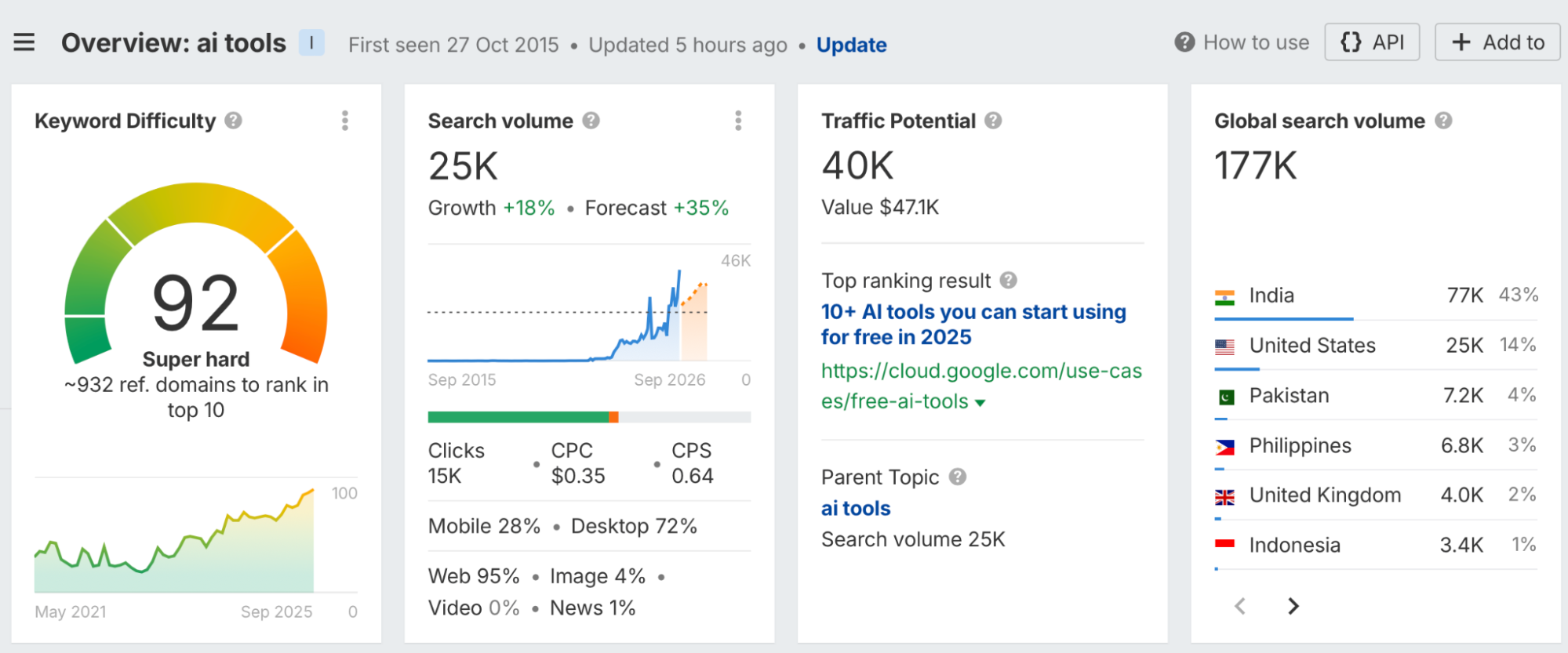

We used basic underlying keyword data to start, including data points like search volumes, keyword difficulty, cost-per-click (CPC), and projected growth rates. Then, we created weighted scores based on different percentage ranges to assess the overall “strategic value” and "commercial value” for each keyword.

Obviously, this is a “generic” topic report. It’s purposefully not focused on a single style of business or topic area. And it’s meant to illustrate the methodology for how you should analyze or break down a competitive space to better understand how to “attack” it.

We can, however, customize these to your particular business – taking into account things like product or customer relevance, existing topical authority and content you might already have, or how to “enter” other competitive topic categories to establish long-term brand dominance.

Our methodology is based on over a decade of getting results in competitive spaces. So if you'd like to customize a similar plan like this for you, reach out.

📊 Here’s the Google spreadsheet dataset for this report. Source data was pulled from Ahrefs and analyzed on September 24th, 2025.

Otherwise, let’s get into the categorized term groups to start.

After “scoring” all of the term groups and keywords within each, we sort them into four strategic categories. Each serves a different business purpose:

For the purpose of this analysis, we’re focusing on the top three to start as they generally provide the best overall “mix” of business value:

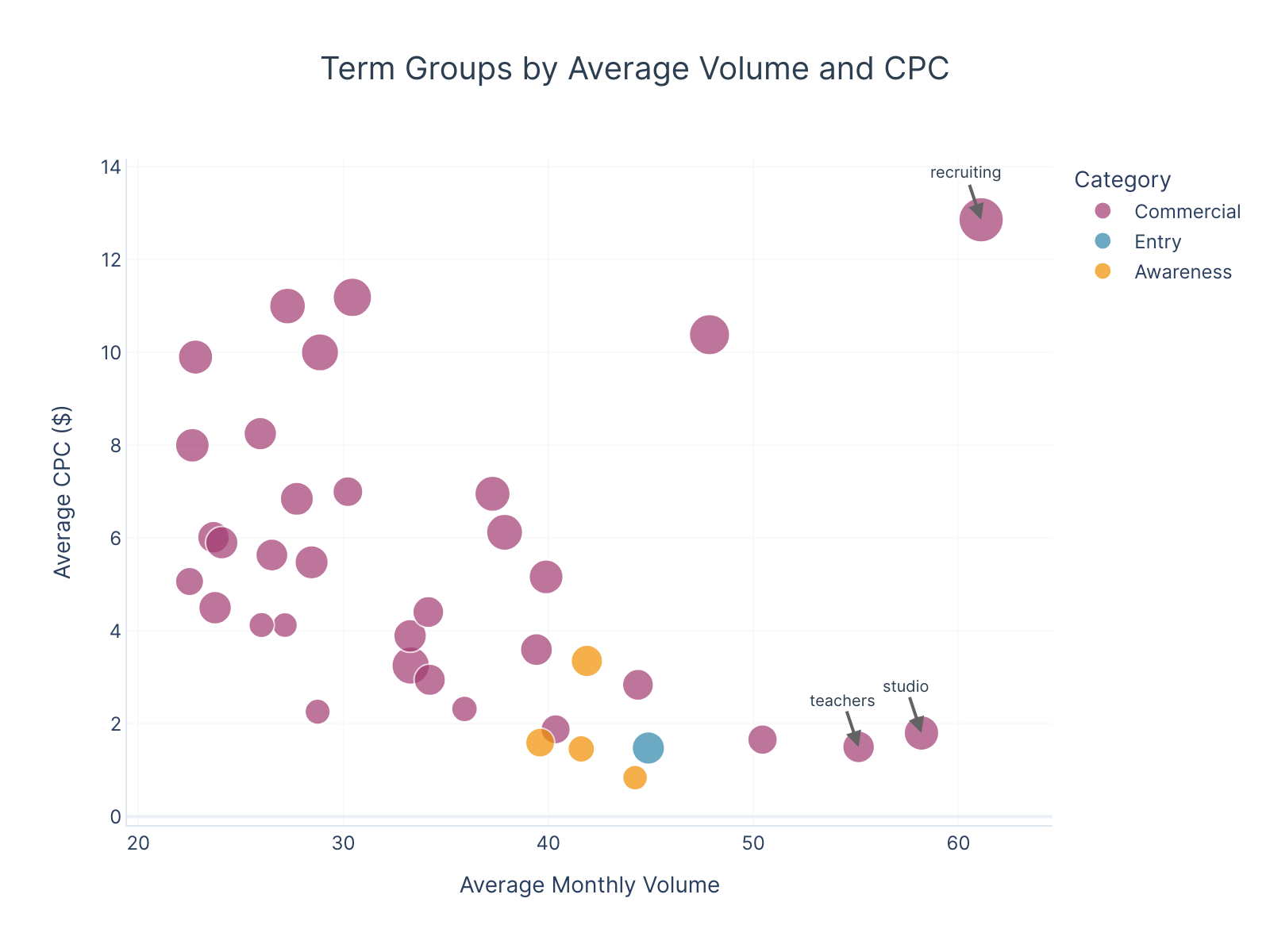

Unsurprisingly, because this is a “tools”-specific topic category we’re analyzing, the Commercial category offers the highest strategic value (40.26) and CPC ($4.23) averages. This hints at strong commercial intent and revenue potential.

Now, let’s start to look deeper into the individual term groups that fall within our strategic categorizations.

If we just focus on average monthly volume and CPC, you’ll see that the “Recruiting” term group offers the best blend of volume (61.1) and CPC ($12.86).

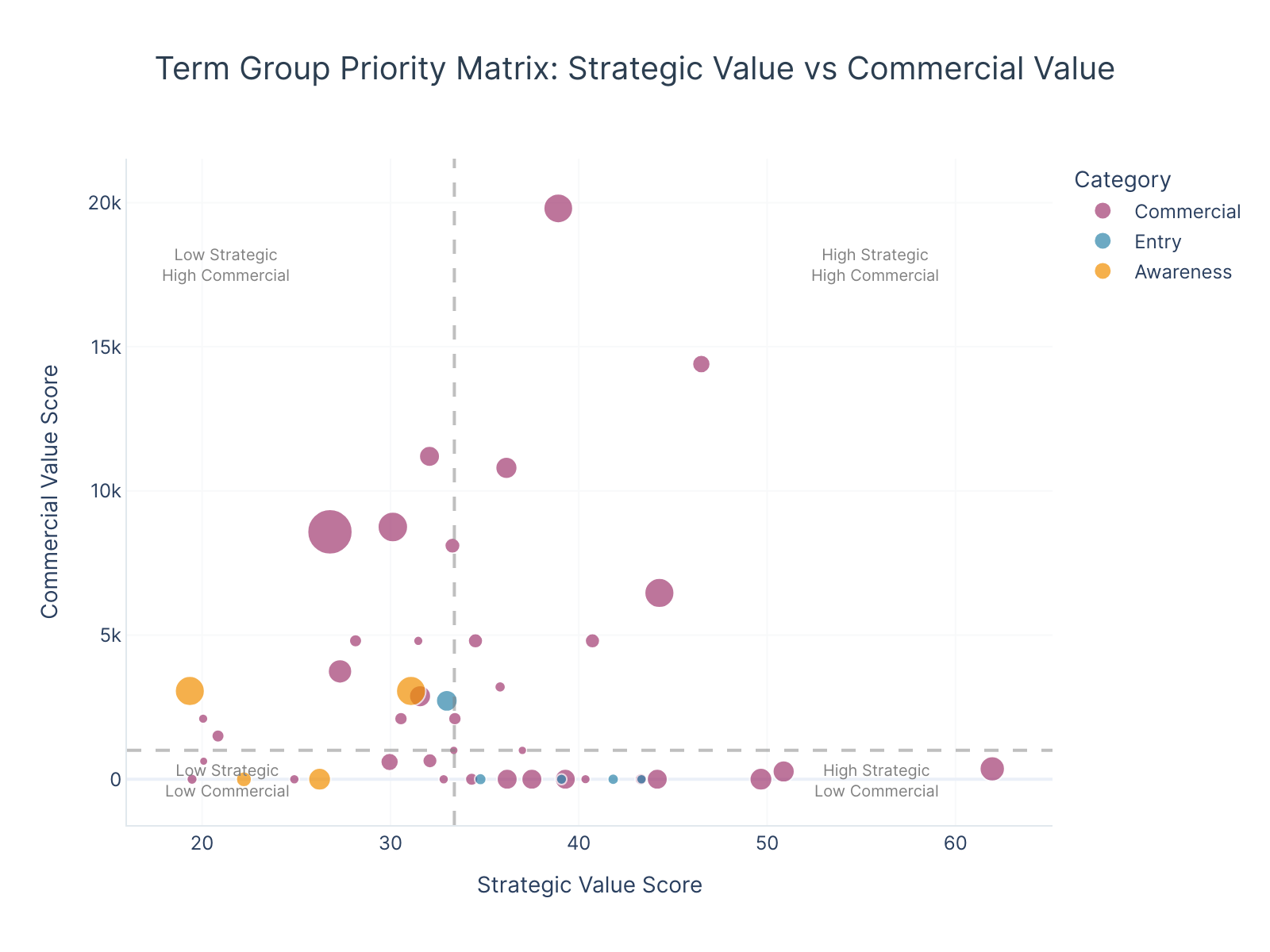

Now, what happens if we re-analyze these term groups across our own Strategy Value and Commercial Value scores?

Let’s find out:

The "Best" and "Marketing" term groups have the highest weighted scores overall (above 1,300).

This initial term group categorization is a starting point. It’s meant to help quickly identify the potential “best fit” term group opportunities to explore further based on your objective (entry into this topic category, increasing potential lead gen, expanding visibility and awareness, etc.).

You can easily skip irrelevant ones or “pull forward” other term groups based on your own individual circumstances.

After categorizing term groups into those three strategic categories, we then analyzed and prioritized the individual keywords. Here’s how the individual keywords within each were scored and sorted:

The high-level results for keyword distribution by priority and category look like this:

Again, “tool”-specific searches lean heavily towards commercial intent. So unsurprisingly, the Commercial category dominates all priority levels, representing 78% of strategic keywords.

Now, let’s take a look at the term groups and keywords in each category.

“AI tool”-related keywords are already competitive and fairly commercial. So the low-hanging fruit to enter this topic category overnight are less as a result.

The Entry category includes 853 keywords across 5 term groups with a combined search volume of 37,710 monthly searches.

These term groups focus on foundational AI optimization and visibility concepts that serve as natural entry points for prospects discovering AI tools for the first time.

These term groups are strategically valuable because they target users in the early research phase who are open to discovering new solutions.

The relatively lower competition in these spaces makes them ideal for establishing initial market presence and building topical authority.

The Entry category delivers 853 high-priority keywords with the following distribution: 598 Expand Authority keywords for building foundational content, 243 Top Targets for immediate impact, and 12 Quick Wins for rapid results.

These keywords are recommended because they provide the fastest path to market entry with manageable competition levels.

Success with these terms can establish credibility faster, creating a foundation for targeting more competitive commercial keywords.

The Commercial category dominates with 21,282 keywords across 37 term groups, generating 685,860 monthly searches.

This category represents the highest revenue potential, focusing on comparison terms, "best of" lists, and solution-specific searches that indicate strong purchase intent.

These term groups are recommended because they capture users at the bottom of the funnel with clear commercial intent.

The high search volumes combined with strong commercial signals make these prime targets for driving qualified leads and conversions.

The Commercial category provides 21,267 high-priority keywords distributed as: 14,667 Expand Authority keywords for market coverage, 6,377 Top Targets for maximum revenue impact, and 223 Quick Wins for immediate commercial gains.

This category is prioritized because it directly drives revenue through high-intent searches. The large volume of opportunities allows for complete market coverage, while the strong commercial signals give you faith that traffic will be high-intent.

The Awareness category includes 4,779 keywords across 4 term groups with 197,170 monthly searches.

These term groups focus on content creation, media generation, and creative AI applications that build brand awareness and demonstrate platform capabilities.

These term groups are valuable for building brand recognition and showcasing your products’ versatility.

While they may not drive immediate conversions, they create touchpoints with potential customers and establish thought leadership in emerging AI apps.

The Awareness category offers 4,779 high-priority keywords with: 3,373 Expand Authority keywords for content coverage, 1,379 Top Targets for maximum visibility impact, and 27 Quick Wins for rapid awareness building.

These keywords are recommended for building brand awareness and demonstrating platform capabilities across diverse use cases.

While conversion rates may be lower, the high engagement and sharing potential create valuable brand touchpoints and support overall marketing objectives.

Successfully ranking for the identified high-priority keywords would generate substantial business impact over the next 12 months.

Organic traffic growth can be significant with 1,178,370 total monthly searches across Quick Wins and Top Targets keywords alone. (So even excluding the other Expand Authority and Low Priority keywords for now.)

This represents significant ROI on content and SEO investments, with ongoing compound benefits as rankings strengthen over time.

Cool. How would you go about doing this?

We typically recommend a strategic approach of prioritizing Entry keywords first, then Commercial, then Awareness to go from penetration to hitting business KPIs and category champion ASAP.

Early wins in Entry categories build authority for targeting more competitive Commercial terms, while Awareness content supports overall brand building and customer education throughout the funnel.

Beyond direct revenue impact, ranking for these keywords establishes market leadership, reduces customer acquisition costs, and helps create your own competitive advantages.

Creating visibility across 98 term groups positions like this can help you become the definitive resource for AI tools information in this case, driving both direct conversions and partner/integration opportunities.

Over the next few sections, we’re going to take a look at how you’d potentially organize all of this information so far to create a 12-month implementation plan that delivers (and beats) these initial projections.

Now, let’s build on the last section. This example 12-month implementation plan prioritizes high-impact opportunities through a systematic quarterly approach.

The strategy focuses on building foundational authority in Quarter 1, expanding commercial reach in Quarters 2–3, and establishing market monopolization throughout Quarter 4.

The prioritization methodology targets Entry and Commercial term groups with the highest strategic value ratings first, followed by systematic expansion into remaining opportunities.

This approach can deliver maximum ROI while building sustainable competitive advantages.

Focus initial efforts on Entry category Quick Wins and Top Targets to establish organic presence and build topic authority.

Target the 12 Quick Wins keywords in optimization and visibility term groups to speed up initial ranking success. Simultaneously develop in-depth content for the 243 Top Targets keywords to capture early market share.

Content development should prioritize practical guides, comparison articles, and optimization tutorials that demonstrate platform expertise.

Each piece should target specific keyword clusters while providing genuine value to prospects researching AI tool options.

Leverage the topic authority you’ve been creating to target all relevant Commercial category opportunities, beginning with the Quick Wins keywords in "best" and comparison term groups.

Develop detailed comparison content, buyer guides, and solution-specific resources that drive qualified leads.

Focus on creating "best of" lists, detailed tool comparisons, and industry-specific AI tool recommendations.

These high-intent pages should obviously include clear calls-to-action (CTAs) and lead capturing to maximize conversion potential.

Expand into Awareness category keywords while continuing to build authority in Commercial terms.

Target the 27 Quick Wins in video and generation term groups while developing content libraries for Expand Authority keywords across all categories.

Create interactive tools, guides, and thought leadership content that establishes the platform as the definitive AI tools resource.

This phase focuses on market leadership and sustainable competitive advantages.

Now that you have a snapshot of the overall implementation plan idea, we’ll focus on the top term groups for each quarter, along with additional details for how to potentially tackle each one.

The first quarter’s focus will be more detailed to give you an idea of how to approach it, while quarters two through four should then be more self explanatory.

The first quarter targets the highest strategic value Entry and Commercial term groups, focusing exclusively on Quick Wins and Top Targets keywords.

This approach establishes immediate market presence while building authority for more competitive terms.

The “recruiting” term group represents the highest strategic value opportunity with 30 high-priority keywords generating 4,440 monthly searches.

This group targets HR professionals and talent acquisition teams seeking AI-powered recruitment solutions. The combination of high commercial intent and manageable competition makes this ideal for immediate revenue impact.

The 2 Quick Wins keywords focus on specific recruiting tool comparisons with low competition, while the 28 Top Targets include recruiting AI searches.

Success in this group can help establish credibility with enterprise buyers and create opportunities for high-value customer acquisition.

The “recruitment” term group complements the recruiting focus with 32 keywords and 4,090 monthly searches.

This group captures broader talent acquisition searches and alternative terminology used by different market segments. The strategic value lies in saturating these related topics and semantic keyword clustering.

Content development should focus on detailed recruitment process guides, AI tool comparisons, and ROI calculators that demonstrate clear business value.

The 2 Quick Wins provide immediate ranking opportunities while the 30 Top Targets build topical authority.

The “2025” term group offers lots of targets, with 1,640 high-priority keywords generating 98,330 monthly searches.

But instead of targeting “2025” - you should be creating and updating these for 2026 right now!

This group captures users seeking current and future-focused AI solutions, indicating strong purchase intent and willingness to invest in cutting-edge technology.

The 7 Quick Wins target specific "best AI tools 2025" searches with faster ranking potential. The 1,633 Top Targets cover 2025-focused searches across all AI tool categories.

This group drives significant qualified traffic and positions the platform as a forward-thinking market leader.

The “sales” term group includes 148 keywords with 11,550 monthly searches, targeting sales professionals seeking AI-powered productivity tools.

This audience typically has budget authority and clear ROI requirements, making them ideal for B2B SaaS conversions.

The 9 Quick Wins focus on specific sales AI tool comparisons, while the 139 Top Targets cover sales automation and productivity searches. Content should emphasize measurable business outcomes and integration capabilities.

The “best” term group provides the largest opportunity with 1,728 keywords generating 148,820 monthly searches.

This group captures users actively comparing solutions before making purchasing decisions, representing bottom-funnel commercial intent.

Important note: make sure to double check SERP overlap with the “2025” term group keywords (or your updated 2026 versions)!

The 59 Quick Wins target specific "best" tool comparisons with manageable competition. While the 1,669 Top Targets include comparison searches across all AI tool categories.

Success in this group can drive qualified leads in addition to cementing market authority.

The “convert” term group focuses on 37 keywords with 7,800 monthly searches, targeting users seeking conversion optimization and lead generation tools.

This audience understands marketing metrics and values measurable results.

All 37 keywords are Top Targets, indicating strong commercial potential despite higher competition.

Content should focus on conversion case studies, optimization guides, and tool comparisons that demonstrate clear ROI.

The “avatar” term group represents the primary Entry category opportunity with 23 keywords and 3,460 monthly searches.

This group targets users exploring AI avatar and persona creation tools, often in early research phases.

The 1 Quick win provides immediate ranking opportunity, while the 22 Top Targets build avatar-related authority.

This group serves as a natural entry point for users discovering AI tools for the first time. (Think: beginner-friendly or focused content.)

The “workflow” term group includes 36 keywords with 2,720 monthly searches, targeting users seeking AI-powered workflow automation and productivity tools.

This audience values efficiency and process optimization.

The 2 Quick Wins focus on specific workflow tool comparisons, while the 34 Top Targets cover automation searches.

Content should emphasize time savings and productivity improvements.

Content development priorities: Focus on creating comparison guides, detailed tool reviews, and practical implementation tutorials for each term group. Prioritize Quick Wins keywords for immediate ranking success while developing authoritative content for Top Targets.

Resource allocation: Dedicate at least 50% of content resources to the three largest opportunities (2025, best, sales) while still allowing enough bandwidth for the most relevant term groups of the remaining eight. Each term group should receive dedicated landing pages, supporting blog content, and internal linking structures.

Example success metrics: Target a 50% ranking improvement for Quick Wins keywords within 60 days and a 25% improvement for Top Targets within 90 days. You should obviously adjust both the percentage ranking improvements or number of days based on the relative strength (or lack thereof) of your existing site.

The second quarter continues building commercial authority by targeting the remaining 13 top-tier Entry and Commercial term groups. This phase leverages the authority built in Quarter 1 to tackle more competitive opportunities while maintaining momentum in revenue-generating content.

Focus on the remaining Entry and Commercial term groups with strategic values between 34.4 and 43.2. There is still a lot of value in these term groups, while building on the foundation established in Quarter 1.

Key term groups include:

Each group receives content development focusing on Quick Wins and Top Targets keywords. Leverage internal linking from Quarter 1 content to boost new pages. Create content clusters within each term group and establish clear conversion paths from Entry to Commercial content.

Quarter 3 expands market coverage by targeting the remaining 21 Entry and Commercial term groups with strategic values below 34.4. This phase doubles down on market coverage while building-in long-term competitive advantages.

These term groups represent significant long-term opportunities despite lower immediate strategic value. Complete coverage here can also help prevent competitors from establishing authority in these spaces, while also building topical relevance for you across the entire AI tools market.

Focus on Quick Wins and Top Targets within each term group while beginning development of Expand Authority content. Create resource hubs for each term group with supporting blog content and internal linking structures. Develop practical guides, tool comparisons, and educational content that establishes thought leadership. Focus on providing genuine value while optimizing for target keywords.

Example success metrics: Target cumulative organic traffic growth of +200% by end of Quarter 3. By now, if you’ve been publishing well organized, high-quality content these past few months, you’ll start to see traffic not just increase incrementally month over month, but doubles or triples.

Now, you can start turning your attention to the Authority term groups and Expand Authority keywords to establish long-term dominance in this space.

The fourth quarter focuses on building market authority through Awareness term groups and Expand Authority keywords across all categories. This phase establishes thought leadership and captures the full spectrum of AI tools searches. Here are some of the Awareness term groups to target now:

Simultaneously develop content for 32,720 Expand Authority keywords across all categories, generating 377,090 monthly searches. This massive content initiative establishes definitive market leadership and captures long-tail search opportunities.

Create resource libraries, interactive tools, and thought leadership content that establishes the platform as the definitive AI tools resource. Focus on educational content that builds trust and demonstrates expertise.

Develop detailed guides, comparison matrices, and industry reports that become go-to resources for AI tools research. Create content that can naturally attract backlinks, be used for citations, and aid social sharing (or paid social and ABM campaigns).

Position your site as the authoritative source for AI tools information through original research and expert insights. Build relationships with industry influencers and thought leaders to help fuel content distribution.

Entering competitive markets isn’t easy. There are entrenched competitors at every turn. Even in a relatively “new” space like AI tools.

Believe it or not, this is actually a good sign. Because competition in business and search = where the money is.

So you don’t avoid competition. You just need to understand how to systematically beat them at their own game.

And if not, we’re just a phone call away