In retrospect, the incredible rise of the fintech industry was predictable.

E-commerce needed digital payment solutions to facilitate faster, more effortless transactions, and traditional banking wasn’t keeping up.

Consequently, the fintech market is expected to grow from $127.6 billion in 2018 to $309.08 billion by 2022.

But, the explosion of financial services offering unique solutions also made it harder for the average fintech company to be heard over the noise.

While fintech lead generation is gaining prominence, companies are likely to make the same mistakes their older SaaS peers have made.

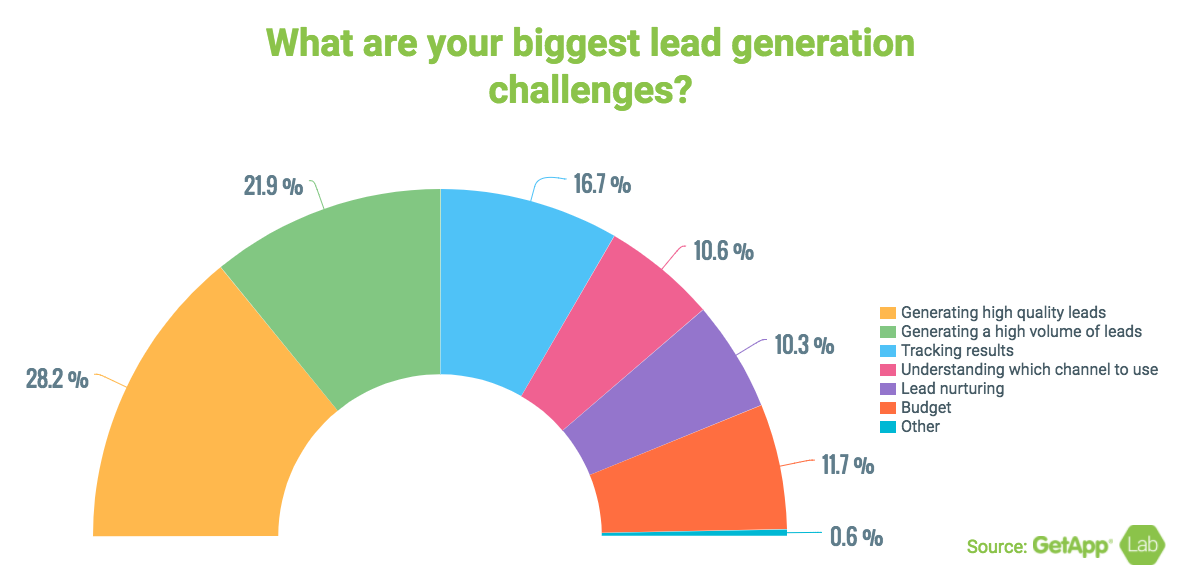

Indeed, generating high-quality leads stays the top challenge for most companies across the board.

So, what makes fintech lead generation so hard?

Often, it is a combination of multiple factors.

As fintech brands are new to the game, they might fall into avoidable pitfalls.

Below, we list five lead generation mistakes you’re likely to make and how you can go round them.

Scale insightful marketing content across the web.

We help you grow through expertise, strategy, and the best content on the web.

You’re Ignoring SEO

New brands often make the mistake of ignoring SEO, thinking it’s a passing fad. Common objections by top management include — its too unpredictable, results take too long to manifest, PPC is way better, etc.

All objections to SEO have a few things in common — they’re either the product of misunderstanding or impatience.

Another common misconception is that since social media is picking up, SEO is no longer relevant.

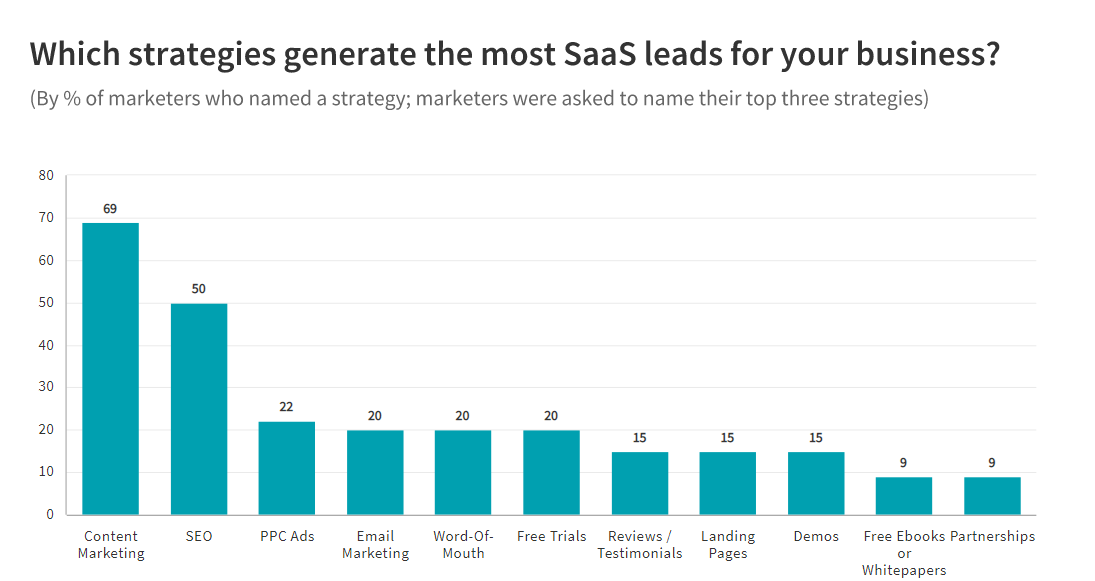

Fact is, SEO continues to prove its advantages even today. SaaS marketing experts still consider SEO and content marketing as the best lead generation strategies.

And even though organic searches contribute to 77% of a SaaS website’s traffic, yet only 11% of companies actually invest in SEO.

Remember that this piece of statistical trivia applies to the entire SaaS industry, of which fintech is still a small part.

In other words, there’s a huge advantage waiting for a fintech startup willing to invest in SEO right now!

High ranks for competitive search terms are hard-won. But, it’s also equally hard to dethrone the winners when they’ve made it to the top.

As fintech software development firms are only now beginning to gain mainstream acceptance, there’s still a lot of space.

There are a few things we recommend you include in your fintech content marketing.

First off, you need to create relevant content that solves your audience’s problems. This means long-form detailed pieces that delve deep into a problem and provide actionable insights.

Since the average length of top-ranking content is 2,312 words, it’s safe to assume that Google prefers them as well.

You also need to include proper content formatting, keyword targeting and density, meta and title tags in each post you create.

Furthermore, your content needs to be broken down into small, easy to read paragraphs that are no more than 1-2 sentences in length. This helps the reader scan through the text and find the information they are looking for faster.

Finally, you need to start thinking of yourself as a publisher rather than a marketer. All search engines reward regularly updated websites. So, your content strategy should include periodic publishing of content as well.

Read more on how to frame a fintech content strategy in our article on content marketing lessons from an 8.3 billion dollar success story.

Your Marketing Doesn’t Include Striking Visuals

Finance, by its nature, is a text-heavy topic dominated by jargon-laden definitions, complex formulae, and calculations.

While text is still the best way to convey ideas, fintech marketing can use visuals to make its content more appealing to modern audiences.

Why is visual content so effective, you ask?

Because we humans are visual creatures first.

Our brains are more adept at assessing the environment as a picture rather than as a paragraph.

Since text is a fairly recent invention, we tend to process visual information nearly 60,000 times faster than written stuff.

And it shows, too.

65% of people could recall a visual after three days, but only 10% could recall textual information.

Millennials, and gen-y’ ers also have a greater preference for visual content. They’re more likely to respond better to visual information and even share it with their friends and family.

You really are only limited by your imagination when it comes to using visual content in marketing.

Here are a few ideas to add to your inbound marketing strategy:

Turn formulas and definitions into infographics

Now, we know that people are more likely to remember visual information.

So, turning the most complex information into an infographic with large fonts and going with design elements will be a better choice here.

Text like finance formulas and definitions are what your audience is most likely to struggle with.

So, presenting them as visually as possible rather than yet another sentence will help your readers understand them better.

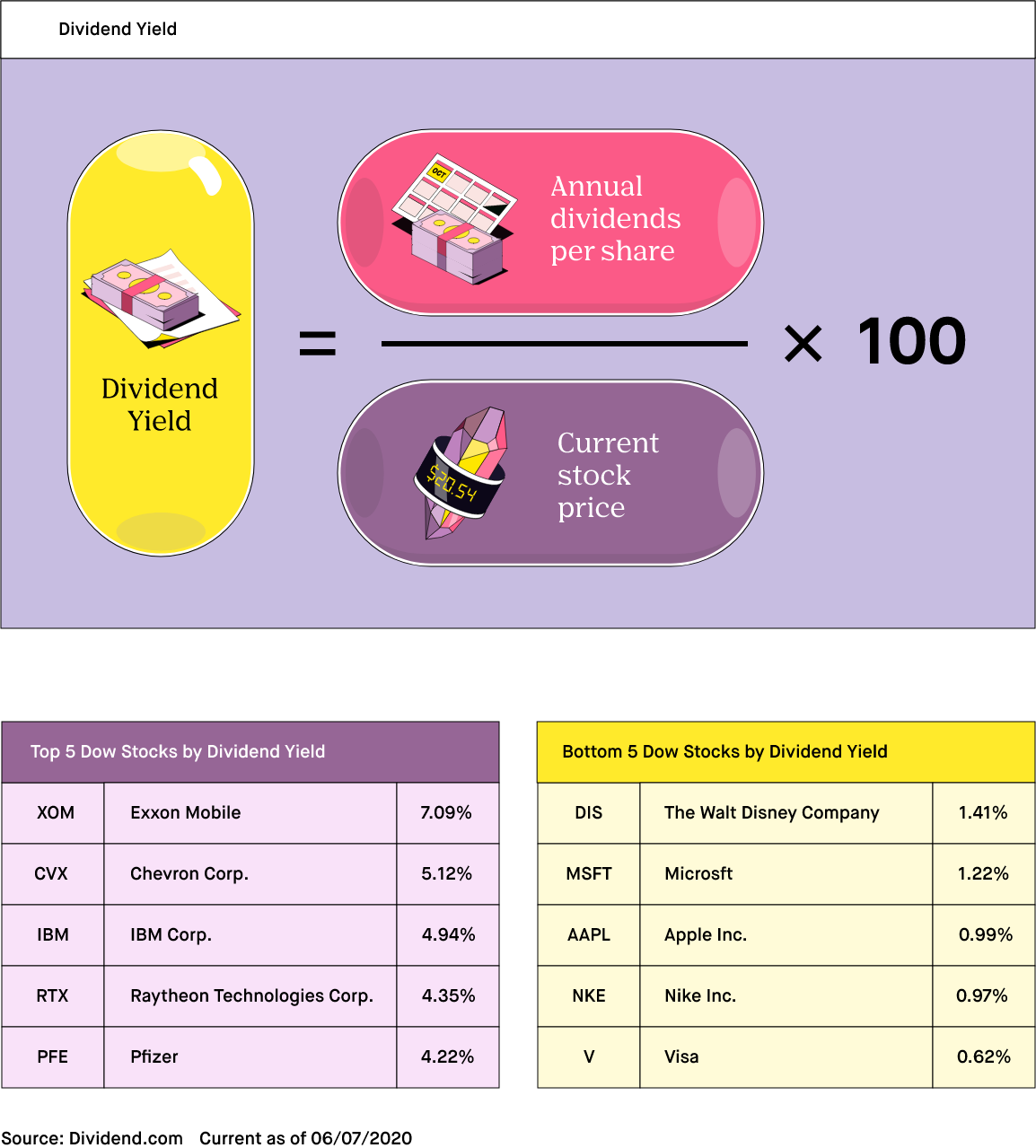

For example, a dividend yield is defined as a percentage of the market price of a share a company annually pays to its stockholders in the form of dividends.

But, you could show it as:

Use dialog boxes and visual examples, wherever possible

Since content marketing attempts to educate the audience on important topics, it can use visual content to tell a story.

Instead of just putting together a bunch of sentences together, think of creating a picture or video of a person explaining the concept to someone.

You can also use comic strips here. Think of telling a story where a protagonist defeats a problem using solutions you are offering here.

Add videos to the mix

If you have fintech products that are hard to explain, then a video will be your best bet.

Videos are a great resource too since 54% of customers want to see more video content from their preferred brands. One of the best ways to showcase videos on your website is by using a video gallery plugin. This way, you can demonstrate your products and services with a series of videos.

Short version: Visuals help people understand your value proposition better. Meaning they will be more likely to sign-up.

Your Lead Funnel is Full of Leaks

While SEO, thought leadership and brand awareness are all important parts of fintech lead generation, your lead-funnel structure needs attention, too.

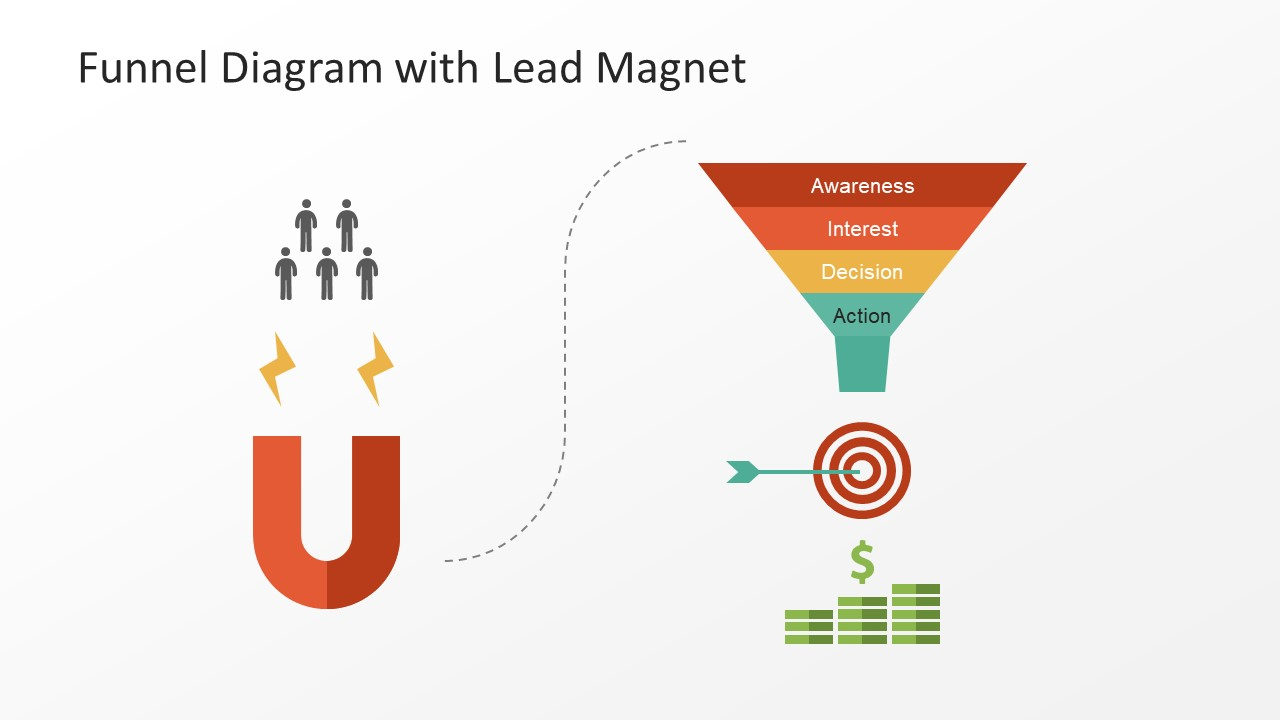

A lead funnel is a systematic approach to earning leads and consists of different stages. Each stage witnesses distinct consumer behavior and needs a tailored content strategy.

The aim of a lead funnel is to help your audience understand your value proposition better.

The deeper a person moves down your sales funnel, the higher the chance they’ll become a paying customer.

A lead funnel begins with a lead magnet, which can be a blog post, video, infographic, or article on a third-party website. Its job is to introduce you and what you do to the world.

As people consume your content, they move into the “awareness” stage of your lead funnel. At this point, your target audience simply knows that you exist.

While some won’t follow-through, there will be those who will show interest and will start researching your solutions. They’ll consume more of your content and may even comment on your articles and social media posts.

A certain percentage of those who have expressed interest will never act and will either go dormant or stop interacting with you altogether.

But, there will be those who will find your solutions perfect for their needs. These people will move to the decision stage and will actively pursue your solutions.

Of the people who have decided, fewer still will choose to act and make the purchase.

A good lead funnel is one in which each stage propels as many people to the next step as possible.

The only way to do so is to create highly targeted, relevant content for every step of your buyer’s journey. And this is where all sorts of problems start to crop up.

You can have potential buyers dropping out at each step. For instance, those in the awareness stage may choose not to proceed because you didn’t include a clear Call to Action.

Even persons who are interested in your products may move away because your marketing team ignored their questions or comments.

Finally, even those who were ready to buy could suddenly disappear because your sales team never followed up with them.

We have a detailed resource on how to create and execute an online sales funnel, so be sure to check it out!

You’re Still Stuck in the Past

All startups are guilty of it. The need to follow the crowd and play marketing safe. And why shouldn’t they?

A fintech brand has a limited budget and huge odds to beat. And to add to that, 90% of startups fail.

It’s easy to reach for the easy way out and go with old-world methods simply because they seem to hold promise. They’re tried and tested, after all.

Even those who are digitally savvy can be sold on old marketing tricks that were never effective.

The pre-Google Panda days of SEO when keyword stuffing and buying links actually worked certainly comes to mind.

But, there’s a reason the world has moved on from these strategies, and so should you.

For starters, old lead generation methods were far more sales-oriented than what we practice today. This is primarily because almost all of them were unsolicited by nature.

Media like print, billboard, TV, newspaper, and direct mail are from a time when consumers didn’t have much choice.

The modern consumer is far more tech-savvy and researches as many options as possible before making a purchase decision.

An average B2B consumer, for instance, consumes 13 pieces of content before deciding on a vendor.

Many will also go through forums, answer sites and social media post comments to find out as much about your service as possible.

Older methods never factored in such a level of consumer empowerment, which is why they are no longer effective.

They leave little room for a dialog between you and your prospects, and just demand compliance.

Modern lead generation strategies look at content as a way to start a conversation with the audience. They provide solutions, probe problems, and incite ideas.

These strategies work for a very simple reason. They rely on accurate data to understand the buyer, then present them with highly relevant information.

Since modern content marketing uses highly advanced tracking and analytics tools, they can also help you refine your strategy as you go along.

When executed with a well-aligned strategy, fintech lead generation can help you get loyal customers like clockwork.

You Have No Idea Who You Need to Be Talking to

We saved the biggest concern for the last. Knowing who to target can be an incredibly difficult task since every organization and customer has different pain-points.

If you’re a financial technology firm, you will wonder whether you should be talking to the CFO, CTO, CEO, CMO or all four?

If you target end-consumers, then what demographics should you go after?

Fortunately, marketers have asked these questions innumerable times before and we have dependable strategies you can work from.

A buyer persona which is a semi-fictional representation of your customer can be an ideal tool for helping you out here.

A good buyer persona should include important information such as your ideal customer’s job description, pain-points, organizational role, and preferred publications.

Depending on your product your fintech marketing strategy can include just one buyer persona, or ten.

There are quite a few ways to collect information for your buyer persona(s)

- Consider diving into your contacts database. Look for patterns in metrics you consider important.

For example, you can look out for what the job title of most of your contacts is. Furthermore, try to find out what content they like to consume.

- If there are some sticking points, then consider interviewing your existing customers to know more.

- You can also tailor the form fields on your website to collect information relevant to your buyer persona. For example, you could add page transitions to your forms to nudge users to the next page after the last field on the current page is filled out.

- Your sales team can provide you with in-depth information about your potential customers and their needs, too.

If you’re interested in B2B lead generation, then Account-Based Marketing (ABM) can provide you with an awesome suite of tools here.

ABM treats each account as a market in itself and allows you to focus on the correct (set of) decision-maker(s) right from the start.

It does so by understanding each account, its internal power structure, and idiosyncrasies. Once you have actionable insights, you can create a highly targeted marketing campaign for each account.

Here’s a complete guide on how to use ABM for lead generation.

Conclusion

You may be tempted to think of fintech lead generation as something special or different. But truth is the same rules apply here as well.

You can learn from well-tested strategies and tailor them to your unique needs.

Here’s a quick recap of everything we covered above-

- Don’t ignore SEO. It still works as long as you do it right.

- Don’t ignore quality visuals. Finance is a text-heavy subject, you can break the mold by making your content more visual.

- Pay attention to every stage of your lead funnel.

- Don’t waste your time and money on old lead generation and marketing methods. They just don’t work anymore.

- Really pay attention to who you need to be speaking to. Use Account-Based Marketing if you’re targeting businesses.

Interested in learning more on how to use content marketing for fintech lead generation?

We’ve been helping SaaS and digital brands create engaging content for a while now and will love to help you too.

So give us a call and let’s get the ball rolling.