Income/expense management is just another headache for a small business. If you’re struggling to keep track of bookkeeping, you’re not alone.

Many entrepreneurs are going through the same tedium of income and expense management. Automation could save you a lot of time and money in this regard.

Fortunately, accounting automation tools do exist. Kashoo is a prime example of an app that streamlines bookkeeping for small businesses. Thanks to its machine learning foundation, the tool categorizes all bank/credit card expenses and transactions, providing real-time reports that are complete and accurate.

In this article, we’re going to delve deeper into Kashoo and some of its options and features.

TABLE OF CONTENTS

What Is Kashoo?

Instead of having to jot every transaction down somewhere or type it into a spreadsheet manually, Kashoo allows you to automate all bookkeeping tasks in your business. By means of automation, this app reconciles and categorizes every expense that you make as a business, using a bank account or a credit card transaction.

The result? Real-time reports that are completely accurate and detailed. It’s as simple as dragging and dropping an image file of any receipt. The platform automatically matches the image to a transaction. Although there is an entire machine learning algorithm behind it, using the Kashoo tool is very straightforward.

Why Use Kashoo?

If you’re wondering whether you should use a bookkeeping app for your business, there is no question about it – you’ll learn that you need it, one way or another. But what about Kashoo? Why use that particular platform?

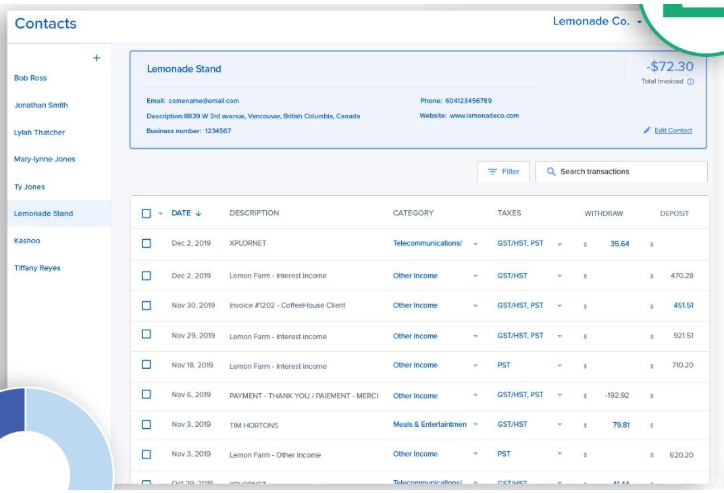

For one, it’s fantastic at managing expenses and income. It’s also brilliant for project costs tracking. Kashoo connects to a financial institution, downloads all the transactions from your account, and reconciles them. All this information is stored in a straightforward user interface with very simple navigation.

In the unlikely scenario that you find yourself in need of assistance, Kashoo support is available via phone, chat, or email.

How to Get Started with Kashoo: A Step-by-Step Walkthrough

Whether you’ve already opened Kashoo’s interface or are considering getting on the platform, you probably want to know how the whole thing works. Here’s how to set up your business using Kashoo:

1. Gather Information

Given the fact that this is a bookkeeping app, you can’t expect that a username and password will suffice. Remember, you’re setting up a business account here. Getting hold of all the necessary information prior to starting the process of Kashoo business setup means a huge deal. Here’s some information that you’re going to need.

First of all, you are asked to provide the legal name of your company and its address. Then, you’re going to have to provide the business number, the Employer Identification Number (EIN), or the Federal Tax ID, depending on what you’re going to use Kashoo for.

Then, expect that you’ll have to add your fiscal year. In most cases, the fiscal year is the same as the calendar year. However, this can vary from business to business.

The final piece of information that you’re going to need to set things up is the sales tax information, which includes the percentage rates, filing dates, filing frequency, and the registration number.

2. Set Up Profile

Go to the Kashoo platform, sign in, and set up the My Profile section. When done, go to the Business Profile section, and provide the information mentioned above. Note that My Profile is used for billing purposes only – the information entered in this section won’t appear on invoices.

3. Set Up Chart Of Accounts

Behind the wordy name of “chart of accounts” hides a very straightforward meaning. A chart of accounts is a list of all financial accounts that your business is going to use. If you plan on using only one, you won’t need to worry about this.

Each account on the chart should contain the account name, the account’s description, and the account number. Kashoo makes entering the accounts very straightforward.

4. Add Contacts

Naturally, to complete, track, and synchronize transactions, you’re going to need to provide Kashoo with customer and vendor contacts. Add these contacts to a CSV, Excel, or vCard file. Then, import this information to the Kashoo platform.

5. Customize Tax Settings

No one likes dealing with taxes, that much is clear. Still, depending on the services or goods that your company provides, you may have to charge sales tax. Have the sales taxes tracked automatically by customizing Kashoo’s tax settings.

6. Set Up Items

The items are everything that your company sells and buys regularly. Input these into Kashoo and this will make creating invoices much faster and easier.

Kashoo FAQs

What is Kashoo used for?

Kashoo is aimed at the small business owner and used to automate a wide variety of bookkeeping tasks. Although freelancers have also been known to use it, this platform is aimed primarily at small enterprises.

What operating system does Kashoo support?

Kashoo is SaaS (Software as a Service), web-based cloud platform. For the most part, it is accessed via browsers. However, an iOS app does exist.

Although the mobile/tablet app doesn’t feature all information available on the web app, it definitely comes close to it. You might not get access to suppliers, clients, and project lists from your iOS device, but the list data within transactions is very much available. Note that an Android app isn’t available as of yet.

What payment method does Kashoo support?

Select Allow Credit Card Payment, send an invoice, and your clients will be able to pay you using MasterCard, American Express, or Visa. No third-party sign-ups, no complications. Kashoo offers direct payment with one of the three world-renowned cards.

“The World’s Simplest Accounting Software”

This article will hopefully help you make an informed decision when choosing your go-to bookkeeping software. We can’t really be sure if Kashoo is truly the simplest accounting software in the world (as claimed on Kashoo.com), but we can tell you that the platform is extremely straightforward.

That said, it is not intended for large corporations and it doesn’t offer some features that freelancers might appreciate. If you are a small business, though, you’re going to love it.