FinTech content marketing faces a challenge all too familiar to companies in technical industries:

The content you publish can be hard to interpret, thanks to jargon-laden language that will stump the uninitiated.

The fact that the content needs to agree with a myriad of laws and regulations only exacerbates this problem.

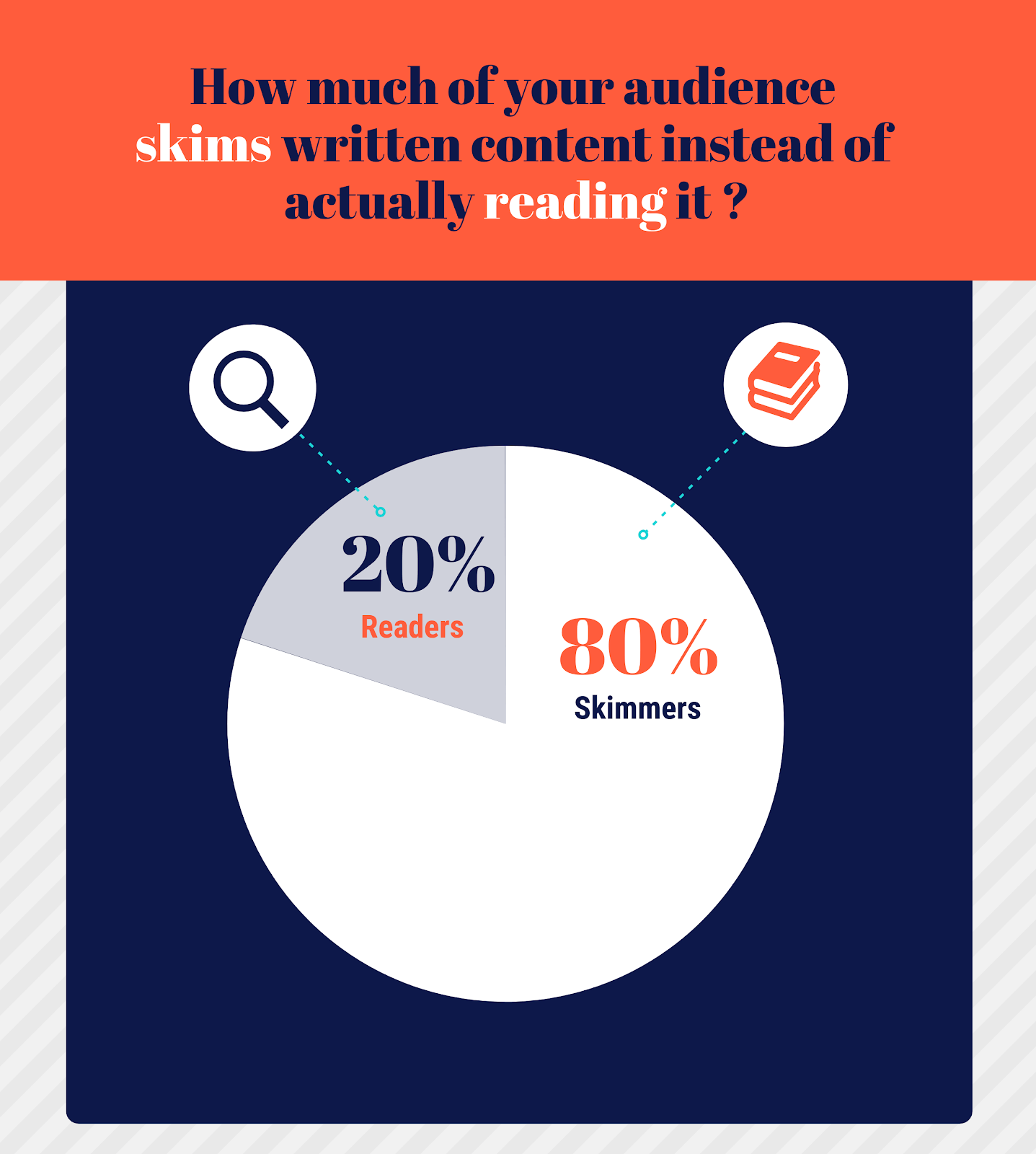

Even high-quality content is quickly abandoned due to ever-shortening attention spans.

Since FinTech is a new, up-and-coming industry, brands are likely to make the same mistakes made by SaaS companies in the past.

Some FinTech startups, however, have learned from the mistakes of their older peers. The unicorn FinTech startup Robinhood is just one such example.

In fact, they have 8.3 billion dollars worth of reasons to show they know FinTech marketing inside and out.

In this walkthrough, we’ll explore exactly what Robinhood got right and what you can take from their content marketing playbook.

Scale insightful marketing content across the web.

We help you grow through expertise, strategy, and the best content on the web.

The Robinhood Success Story

Much like its medieval English namesake, Robinhood is a fintech brand that’s about standing up for the masses.

Baiju Bhatt and Vladimir Tenev founded Robinhood in 2013 to democratize online trading by offering zero-commission trades. This is a first for the fintech industry.

A customer need not pay any charges to open, keep, exchange, and deposit funds. The fintech business has no offices and runs entirely online and has its own clearinghouse to lower costs.

While their success is no doubt because of their generous, well-thought-out business model, their inbound marketing content strategy has played an important role as well.

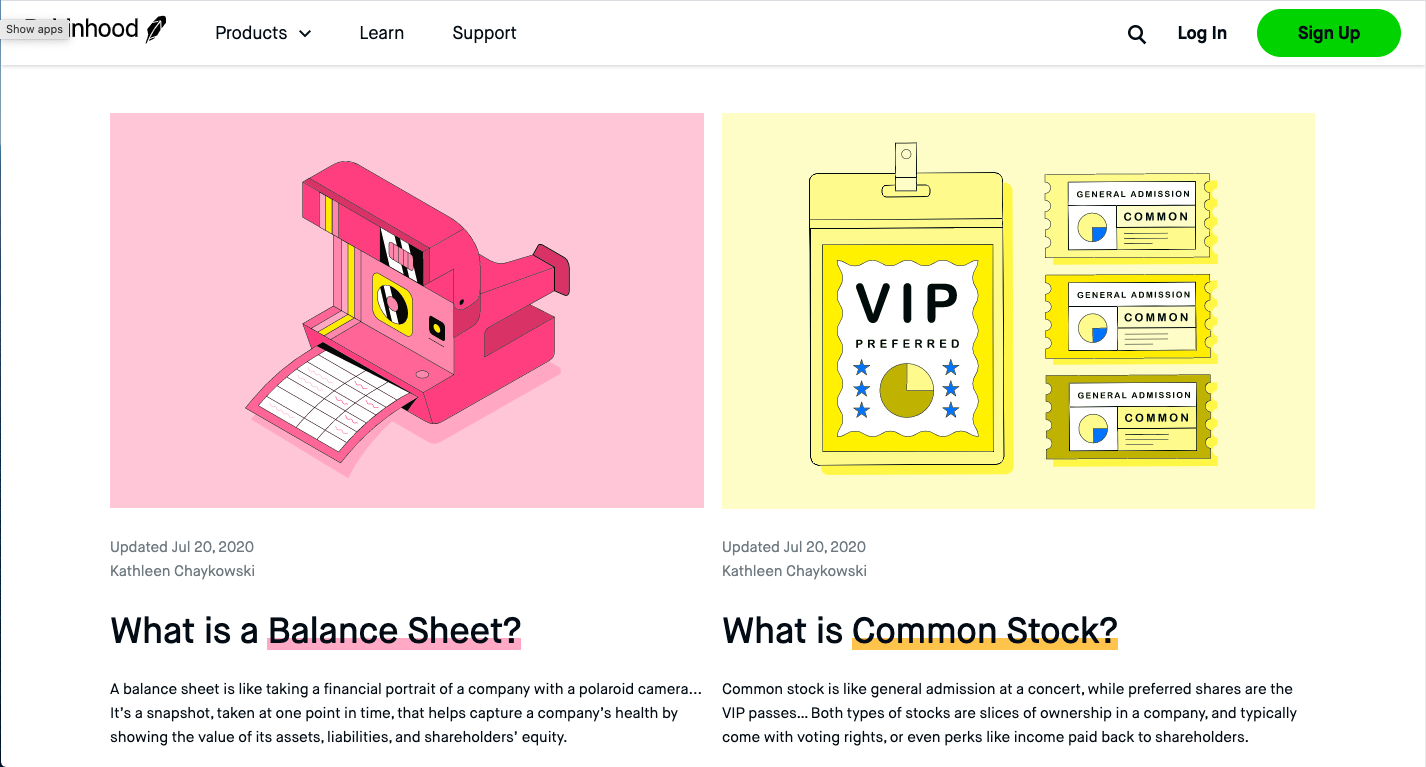

Robinhood approached Codeless to create a new section called “Learn,” in which they would share more evergreen content targeting their prospective client’s questions.

The task was challenging to say the least. Not only was the content supposed to explain complex topics easily, but also be legally compliant.

They also needed a lot of thought leadership content to compete with the likes of the Motley Fool and NerdWallet, and build brand awareness.

We put together a marketing team of writers, subject matter experts, editors, and strategists to create a content assembly line.

Over the last 12 months, we’ve created over a thousand pieces on everything from the most basic to highly complex financial topics.

We took special care to avoid some common traps plaguing technical FinTech marketing. All financial terminology was explained in easy to understand language. Detailed examples were given to illustrate calculations.

We also made generous use of storytelling to make the content more relatable to their target audience.

Our joint efforts paid off spectacularly. Many of our content pieces now rank in first position for highly competitive keywords.

What did we learn about FinTech content marketing while working with Robinhood?

Here are our top four lessons and suggestions for fintech content marketing.

#1: How to Simplify the Complex

In Doug Kessler’s 2013 diatribe slidedeck “Crap. Why the Single Biggest Threat to Content Marketing is Content Marketing,” the content marketing guru noted that much of the content being created is just “meh.”

It overpromises, underdelivers, disguises the boring as profound, and forces useless information onto the reader.

As harrowing it may sound, most of the financial content floating online fits into this problem’s scope a bit too well.

Try looking up the definition of a financial term. Let’s take “debenture” for example…

A quick Google search gives us:

“a long-term security yielding a fixed rate of interest, issued by a company and secured against assets.”

What about the definition of a derivative?

“A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset, index or security.”

Now, both definitions are complete. They tell you exactly what they mean as quickly as possible.

So, what’s wrong then?

Well, both will also give a long “Ummm moment” to anyone unfamiliar with financial lingo.

For instance, to get the debenture definition, the user will need to know:

- What “security” means in finance.

- How the rate of interest works in relation to securities.

- How assets are secured.

And the derivative definition doesn’t fare any better because:

- It kind of sounds like just a regular loan given against collateral. If it actually is a loan then why not just call it that?

- It doesn’t even hint at how the parties agree upon the underlying financial assets.

- It assumes the reader knows what an index and security is.

- Aren’t indexes and securities financial assets too? If not, then what’s the difference?

Finance experts will no doubt rofl at these questions. But the fact remains that most of your customers don’t know as much as you and will think along these lines.

In the absence of a satisfactory answer, they’ll simply move on to the next site in hopes of curing their curiosity.

So much for customer acquisition.

Unfortunately, the financial landscape is literally littered with such definitions that “seem” to tell a lot, but lead to more questions than answers.

This problem can easily creep into FinTech content marketing as brands have to work with the same definitions.

Besides, using words and phrases others might not understand is demeaning. Subliminally, it signals the reader he/she is being shown their place rather than being helped.

In other words, such content doesn’t invite, it repels even though it may seem “high-quality.”

For example, they chose to define debenture as — “a type of bond that isn’t backed by any sort of collateral — The lender trusts the borrower to pay it back.”

Pretty self-explanatory. The only question you’re left with is — what’s a bond? Robinhood defines it as — “an IOU that’s issued by a company, government, or institution in exchange for cash.”

Robinhood’s strategy follows the basic tenets of FinTech marketing best practices.

Nothing is assumed. All financial terms are explained in a way that even a six-year-old could understand them.

Furthermore, their content is also paired with infographics and pictures and is “snackable” so the reader can skim through it.

Now, you could try and simplify everything on your own.

But, a better way would be to include someone from your target market not familiar with finance in your content team. Have them read through your content and make a note of all the questions they ask.

Now, have your writer go through each content piece and rewrite it in a way that answers all of the questions.

Basically, your content needs to (kind of) read and sound like the “Here’s to explain” parts of The Big Short.

But simplification is just one aspect of digital marketing. You don’t want to turn your content into an instructions manual either.

For that, you need to…

#2: Master the Art of Storytelling

The year is 2010. The tremors of the 2008 market crash aftershock are still reverberating in everyone’s memory.

No one was more hit by the ensuing fallout than millennials and small business owners. Laden with college debt, the average 20 something-year-old found no takers for their skills.

How could they? Their prospective employers had no money to pay them with.

In the months and years that followed, the occupy wall street movement began to take shape.

Financial institutions became targets of the mass’s wrath for their greed, fraud and corrupt influence on government policy.

It was their push to portray subprime mortgages as Triple-A to profit that led to the whole fiasco, after all.

The sentiment also took a very concrete shape. Millennials began to reject trading en-masse as a sign of protest against banks and big finance.

They couldn’t have traded even if they wanted to. Most of these financial services made their coin on trading fees which ranged from $5 to $15 per trade.

This is where Robinhood stepped in. Tenev and Bhatt have been building high-frequency algorithmic trading software for financial services for a while now.

Both had seen the anger of occupy wall street first hand and both could also relate to it. Consequently, a realization struck the young developers.

Millennials didn’t hate trading, they hated the institutions that erected huge entry barriers to maintain their own trading exclusivity and profits.

But, how would they respond to a broker that took out the typical practices of a legacy institution, the two wondered? What if they offered a platform that had no trading fees at all?

The young entrepreneurs turned this idea into a financial technology company which they called Robinhood and opened it up for signups in December 2013.

It’s not like their idea was appealing to all. In fact, Robinhood was rejected by 75 venture capitalists before they found seed funding.

By September 2014, Robinhood had a waitlist of 500,000 users. By May 2018, the startup was valued at $6 billion.

And on May 4th, 2020, Robinhood announced it had successfully raised $280 million in series F funding, increasing its capital to $8.3 billion.

So, what does the Robinhood story tell us?

All founders have a profound reason for starting their enterprises. They were either confronted with a problem that had no immediate solution, or, couldn’t stand the status quo.

This reason is a fundamental aspect of the startup ecosystem. It also helped them connect with their market on a very fundamental level.

Robinhood emulated Apple by emphasizing customer experience more than its competitors.

And, much like Apple, Robinhood too has developed a cult-like following online.

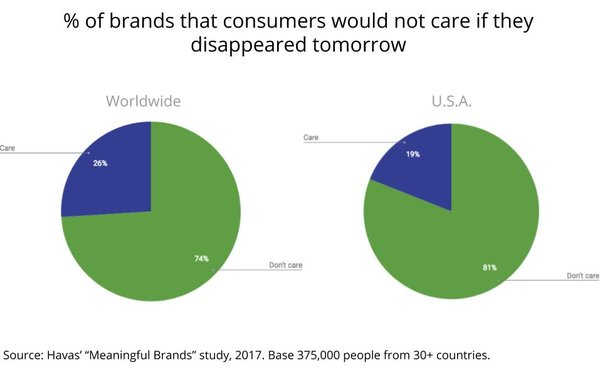

It’s a foregone conclusion in content marketing that meaningful content is what helps brands connect with potential and existing customers.

In fact, 74% of brands could disappear tomorrow, and no one would notice.

While sharing content that helps is important, storytelling is what allows you to create emotional connections.

The best way to help your readers associate with you here will be to think of storytelling from the perspective of shared trauma.

We instantly connect with those who have gone through the same traumatic experience that we have. Think of the bond between military veterans who have returned from active duty.

Only those who have been there and done that will know what it feels like. And those who do will instantly relate with one another.

Even Robinhood’s story hits us in the feels because the founders knew exactly what their peers were going through. More importantly, they committed themselves to helping fellow millennials.

Some questions that can help you out here:

- What problems have you faced that most of your users are also facing?

- Does your product address those issues?

- Did you come up with a creative way to tackle the problem? If so, what was it?

- What can you tell your users that can help take the edge of right now?

#3: Publish a Lot

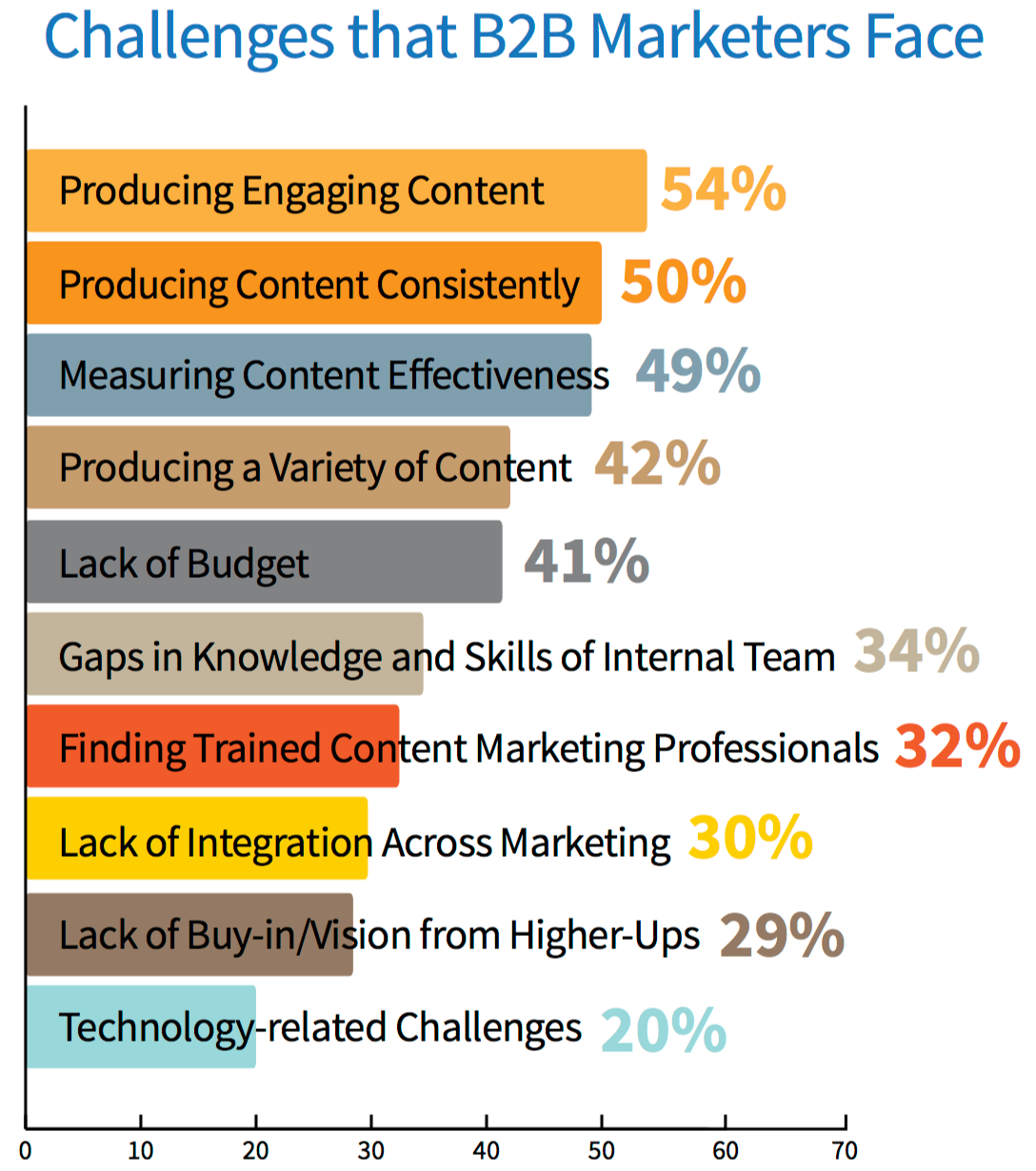

So far we’ve covered how to put together a FinTech content marketing strategy that delivers value. But, value itself can be a shifting goal post.

Your users won’t keep consuming the same content you published that one time unless they need to. Also, new situations will present new challenges that you’ll have to address with new content.

Your publishing volume will also impact brand engagement. Each time you publish a piece, you have a chance to solve a new problem and also get more eyeballs to your site.

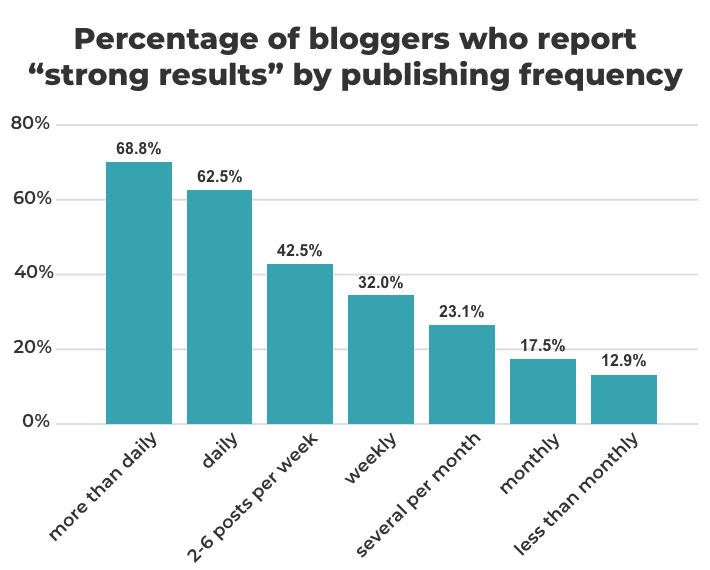

Indeed, blogs that publish more get better results.

How often should you publish?

Since all of us want to fill their sales pipeline with high-quality leads asap, the only thing holding you back will be your budget.

Just so we’re clear, a slow publishing rate doesn’t necessarily spell disaster for your efforts. It might just take you a bit longer to achieve your goals and create a high quality lead magnet.

Ideally, you’ll want to pace your efforts so that you don’t run through your posts in a short span of time.

Remember, every time you publish, you have a reason to reach out to your users and audience. But doing so too often too soon can have the opposite effect.

Our suggested frequency for posting blog posts is two to six articles per week. This will allow you to stay in touch with your audience and have a healthy inventory of content, too.

A word of caution — publishing volume should never turn into a goal in itself. Only create something if you know that it can help someone.

This, however, shouldn’t be a problem for FinTech marketing strategy.

Think of it this way — financial content is already suffering from a quality problem, which we talked about above. Your content can target its shortcomings.

Robinhood’s content strategy consists of thousands of pieces on common finance terms and concepts. Each piece is written in a way that makes it relatable to its users and target persona.

You can do the same.

Think of how you can make finance more accessible to your target market, and you’ll never run out of ideas. And remember to strengthen your efforts by keeping track of the right blog KPIs.

Final Thoughts

Robinhood’s story proves that even the most technical content can be made entertaining and relatable with some imagination and effort. It also shows that such content works!

Here’s a “too-long-didn’t-read” (TL’DR) version of everything we covered:

- Since finance is technical, keeping content as simple as possible needs to be emphasized.

- You can simplify your content by having people unfamiliar with finance on your marketing team.

- Storytelling helps increase the relatability of your content.

- Publish at least two to six articles a week for optimal results.

Feel free to learn more about Robinhood’s content marketing here.

Now, storytelling is hard work. It takes effort to build a compelling narrative that people can relate with. But, that’s also what we do best.

Get in touch with us if you’d like to know more. We’d love to help you tell your story to the world!