The insurance industry is changing. And for your company to thrive in the coming years, you need to stay relevant.

That’s where intelligent content marketing comes in. It’s a tactic that allows you to engage with prospective customers and educate them about what you do by providing them with relevant content that they want — and need — to see.

You’ve reached the right place if you’re looking for new and innovative ways to market your insurance company. Here are some content marketing methods that can help you get a wider audience, attract more customers, and make more sales:

Get long-term ROI.

We help you grow through expertise, strategy, and the best content on the web.

1. Understand your Audience

Insurance companies have a lot of content to produce and need to be smart about how they do it. To succeed in any industry, you have to understand your customers. And it’s no different for insurance companies.

Here are four strategies that’ll help insurance companies create content that resonates with their audience:

- Find out what your customers need and want, then give it to them;

- Make sure your content is helpful, not promotional;

- Connect with your customers on social media platforms like Facebook and Twitter, where they spend days discussing their interests and concerns;

- Create unique value for your audience by producing articles or videos not available online, such as an interactive infographic or a video explaining a complicated topic in simple terms.

To provide a better experience for your customers, it may be worth resorting to insurance technology consulting to automate some aspects of reaching your audience.

2. Maintain a strong brand image

A strong brand image can help you win customers and keep them. It also enables you to attract and retain top employees, who’ll be eager to work with a company known for its quality products and services.

Your brand is your promise to customers — it’s what they expect from you and what they’ll expect from any future products or services your company offers. Therefore, your brand should be consistent across all platforms, including social media posts, advertising campaigns, and customer service interactions.

For example, if you’re an insurance company, such as bizinsure, people may think of you as dull and uninteresting because insurance companies rarely make headlines with exciting new products or services.

However, suppose you try to change this perception by creating more exciting content than others in your industry. It could raise a red flag that you’re trying too hard to be hip and trendy. That could turn people off and drive them away from your brand.

That said, you must strike a balance between your goals and your brand image that’ll still resonate with your audience. Pumpkin does this great on their dog insurance page, striking the perfect balance.

3. Use client testimonials

Testimonials are short, personal statements that describe the experience of a product or service from a company. They may be both positive and negative. Testimonials can come from customers, employees, or others who have interacted with the company.

Creating content that shows your business in a good light is an effective way to build trust and encourage potential customers to choose you over your competitors.

Testimonials can help you highlight real people who have used your products or services and had a positive experience with them. Doing this enables you to connect with potential customers on an emotional level. They’ll feel like they’re hearing from someone just like them rather than just reading words on a page.

Client testimonials are more believable than most other types of content. Consumers want to know what other people think about your insurance company before using your service. When you share client feedback, you’ll help them feel comfortable making their own choices because they can see what others have experienced with your company.

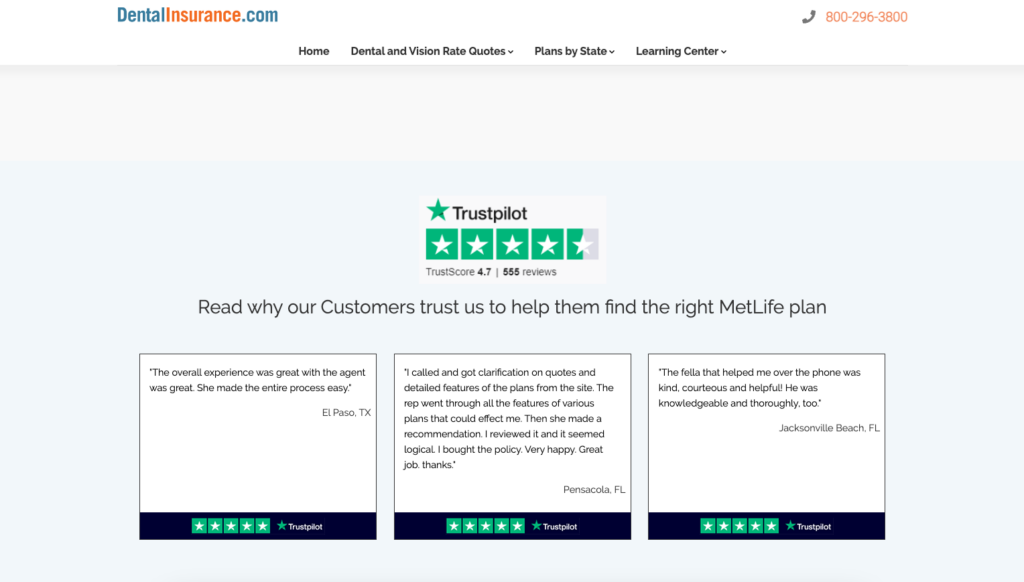

Take an example of Dental Insurance, a company that compares multiple dental insurance plans. Their website has a dedicated page featuring MetLife dental insurance, showcasing client testimonials gathered through TrustPilot, a reputable review platform. These testimonials offer valuable insights into the experiences of real customers who have chosen MetLife dental insurance, adding more credibility and trust for other potential customers.

Insurance is a complicated product, and many people are unsure how it works. To help clients and prospective customers, use testimonials to show people why they should choose you.

4. Use video to engage clients

Video marketing is one of the most valuable ways to establish trust, promote your brand, and communicate with your customers. It’s also great to increase engagement with your content and website visitors.

Insurance companies have a lot of helpful information to present in video format. Here are some examples:

- Product features and benefits: A short video showing how a product works can help educate potential customers about what they can expect from the product or service. Understanding the basics can help them make better purchasing decisions. Based on customer feedback and interest, you can also use your videos to test different products;

- How-to videos: These videos are viral on YouTube because they’re easy to digest and don’t require much time investment from viewers. Viewers also tend to share them widely across social media platforms like Facebook and Twitter; The good news is that you can easily create these yourself with a YouTube video maker tool. These tools take the hassle out of editing, letting you focus on sharing your knowledge and growing your channel.

- Create a series of videos that shows your company in action: Create a series of videos showing employees at work interacting with customers or taking calls from customers. Videos like this will help potential customers see what it’s like working at your company, which will help them feel more comfortable doing business with you.

5. Create a comprehensive blog

The insurance industry has many different niches and types of insurance. However, for a company to make money, it needs to be able to provide its customers with what they need. One way that insurance companies can do this is by creating a comprehensive blog where they can discuss all aspects of their industry.

A blog is a perfect way to share your expertise, educate your audience, and make them feel like they’re part of the conversation. It’s also a great place to experiment with new ideas and techniques that can help you improve your overall strategy.

A comprehensive blog will allow an insurance company to give information about all aspects of their business, including:

- Insurance policies: Starting from life, health, and property and going granular into pet or engagement ring insurance, policies differ across industries. The bl discuss the different types of coverage and how they work. It can also explain how these policies fit into each person’s life and what kind of situations they might come across in which they’d need insurance;

- Types of vehicles: This covers any vehicle, from cars to boats or even airplanes! Anything with wheels could fall under this category. The blog will discuss how these vehicles work and how you can protect them with insurance if needed;

- Medical conditions: This category covers any medical condition someone may have, such as cancer or diabetes. It also includes mental illnesses like depression or anxiety disorders so that someone who suffers from these issues doesn’t feel alone.

Creating a blog can attract more customers and increase your profits. Here are some benefits that you’ll gain by having a blog:

- Your customers can make an informed decision about their insurance needs;

- You can engage with your customers better;

- You can improve customer retention rates.

6. Keep up with social media marketing

In today’s world, social media marketing is a must for all companies. People use social media platforms such as Facebook and Twitter to get information about products, services, and brands. These platforms are where insurance companies can reach out to their target audience.

Social media marketing is essential because it allows you to reach more people simultaneously. Instead of just targeting one person individually, you can target thousands of people at once through your posts. If you’re selling insurance products or services, post your ads on Facebook, where millions of people will see them daily!

You also need to know how to use social media effectively to get results from it. You should always post engaging content that interests people and encourages them to watch your videos or read your blog posts. Then, if they find something useful in what you posted, they’ll probably share it with their friends and family members who might be interested in the same topic as well!

7. Don’t forget about email marketing

Email marketing is one of the most effective forms of marketing. However, you must understand what works and what doesn’t to succeed.

Here are some tips on how to get started:

- Create a list of potential subscribers from your website visitors or customers. You can ask for their email address at checkout or registration. If you already have an email list, add them to your database;

- Use tools like MailChimp or Activecampaign to manage your list and send out newsletters regularly so that people remember who you are and what you offer them as a company;

- Convince people that they need your product or service through content that explains why it’ll solve their problems better than competitors’ products or services.

Aside from the tips mentioned above, here are some ways you can use email marketing to your advantage:

- Send drip emails: Drip emails are emails sent over time, each containing new information or tips on a particular topic. Drip email campaigns are a great way to stay top of mind with potential customers without being too pushy;

- Send newsletters: Newsletters are also effective at keeping people engaged with your company and what you have going on in the industry. You can opt to send them monthly or quarterly, depending on how often you have new information, product or service updates;

- Ask for referrals from current customers: Ask customers if they know anyone else who could use your products or services. When they make connections with potential customers, it means more leads for you in the future.

8. Host informative webinars

A webinar is a live broadcast that takes place over the Internet. Webinars are great tools for presenting information, answering questions, or conversing with participants. Many insurance companies are using webinars as part of their content marketing strategy to educate consumers about various insurance products and services.

Here are some tips for creating an effective webinar:

- Identify your target audience and their pain points: Before creating a webinar, you must know your audience and their needs. If your target audience are young professionals with families, hosting a webinar on how to purchase life insurance policies for dependents may be beneficial. Similarly, if most of your prospects are older individuals interested in retirement planning options, a webinar on saving money for retirement may be more appropriate;

- Create an outline: After deciding on a topic and defining your target audience, create an outline highlighting key points that’ll help educate attendees during the event. The outline should include topics such as: What is life insurance? Why should you buy it? What are the kinds of insurance?

- Invite influencers in your industry: You want knowledgeable people to speak at your webinar so they can share their expertise with others in real-time. Featuring expert influencers will help build credibility around your brand and demonstrate that you’re also an expert in what you do;

- Create an outstanding presentation: Many people would rather watch a video than read through pages and pages of text. So make sure you have an excellent presentation prepared for your attendees. It should be easy on the eyes and include visual aids such as graphs and charts where appropriate. You can even use presentation apps to create beautiful presentations. For a truly interactive experience, consider leveraging the features offered by the best webinar platforms, like live polls, Q&A sessions, and breakout rooms. Tools like Zoom Webinar or Cisco Webex Meetings can elevate your webinar to the next level, fostering a dynamic and engaging environment for your audience.

Conclusion

If you’ve been following along, you know that insurance companies need to do a lot more than just sell their products. They need to give their customers the best possible experience, which means integrating content marketing into their operations.

By pursuing the strategies in this article, you’ll be on your way to creating an intelligent content marketing strategy that’ll help keep your customers happy and engaged.