Technological innovations have given customers of financial institutions an increased ability to take control of and manage their finances. They’re expecting more out of their banks, advisors, real estate agents, and insurers.

Fortunately, many of these emerging technologies help meet these customers’ increased demands in two ways:

- Freeing up time, energy, and resources

- Enhancing the customer’s understanding of their money

In this article, we’ll go over some of the top emerging technologies that are changing financial services and how financial professionals can expect them to shape the nature of their work.

Scale insightful marketing content across the web.

We help you grow through expertise, strategy, and the best content on the web.

What are the Major Emerging Technologies in Finance?

There are five major emerging technologies that could permanently change the finance industry:

- Artificial intelligence/machine learning

- Blockchain

- Robotic process automation

- Digital experience platforms

- Augmented and virtual reality

Automation is one of the most prominent technologies that’s already taken hold.

In a 2017 interview with McKinsey, London School of Economics’ professor Leslie Willcocks reported that RPA could generate a 30%-200% ROI within the first year of implementation.

That makes logical sense — RPA allows firms to offload time-consuming, mentally draining manual tasks. This lets professionals dedicate more time and brainpower to building relationships with customers and finding creative solutions to problems.

Naturally, this also means AI and machine learning will grow in importance because they take automation beyond routine manual tasks and help with higher-level work.

Augmented and virtual reality are slightly further out, but we already see some of these in action today.

Perkins Coie found that commercial real estate is one of the top sectors for AR/VR use. Hence the demand for specialized real estate web design techniques that can effectively incorporate AR/VR into websites.

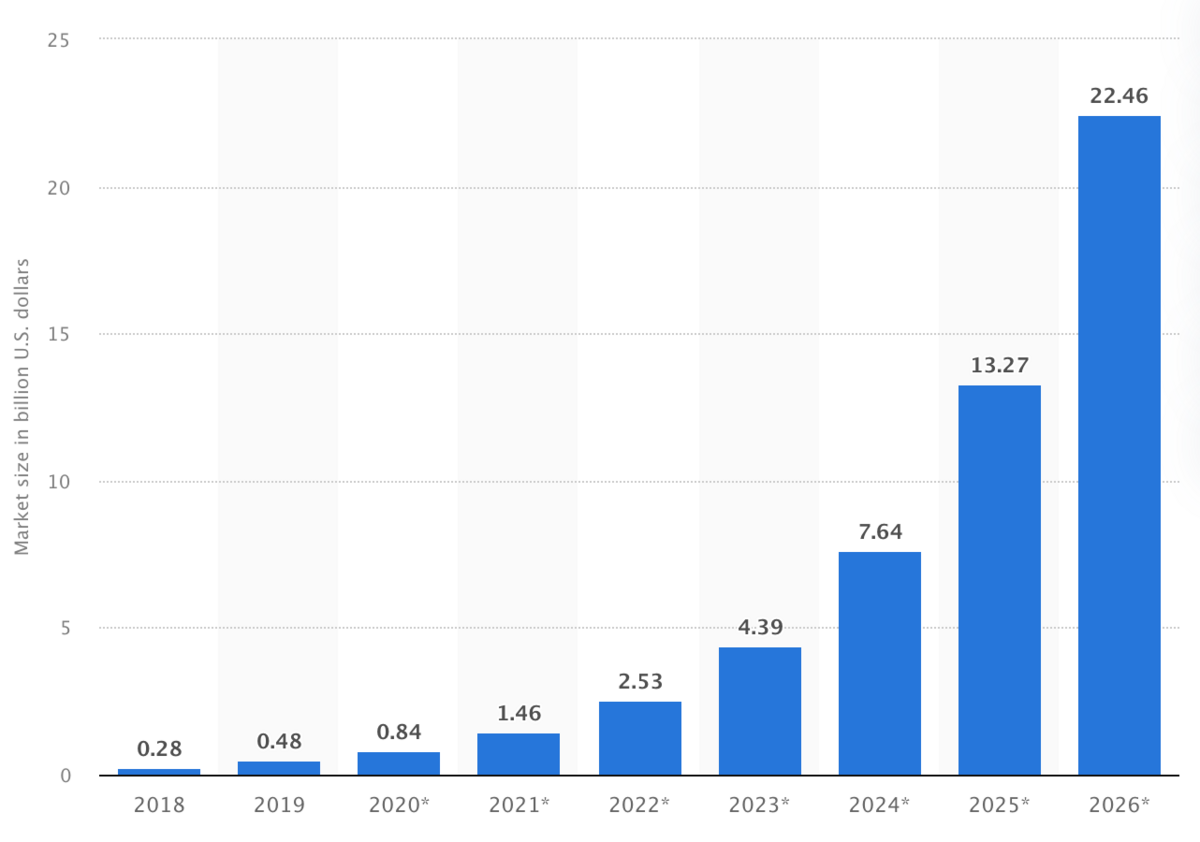

Blockchain is a similar story. We’re just learning to tap into its potential now — but by 2026, the financial services blockchain market size is expected to climb as high as $22.46 billion.

How Emerging Technologies will Impact your Financial firm

Now that we’ve introduced some of the most important emerging technologies relevant to the financial sector, let’s discuss how they’ll impact the main subsectors within finance — for firms, professionals, and customers.

1. Artificial intelligence/machine learning and chatbots

Artificial intelligence involves creating computer programs that can accomplish tasks that would normally require human intelligence. Machine learning sits within the field of AI, involving computer programs that can improve themselves automatically.

Overall, both technologies will help cut out repetitive or manual tasks like receipt tracking and expense reporting, helping professionals focus more on the people side of finance.

Banking

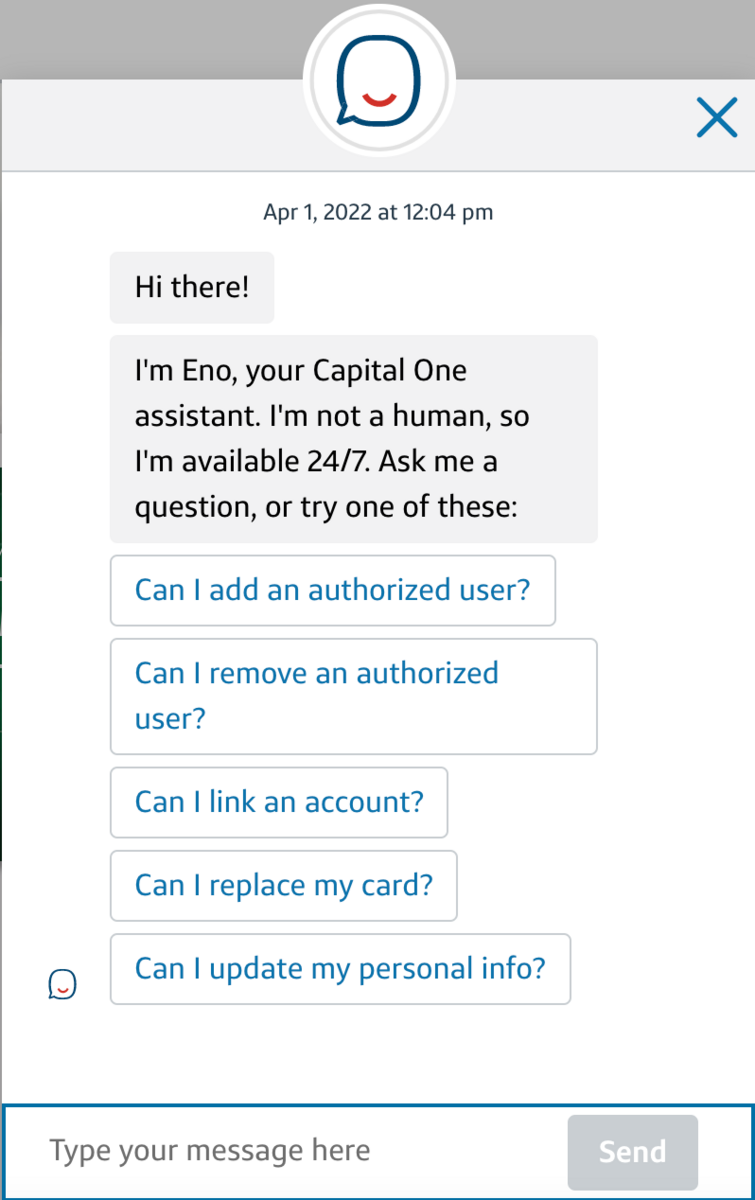

Many banks are implementing AI in their customer service via chatbots. These programs can simulate a real person without involving a human and help with many common customer concerns, saving bank employees time.

These days, chatbots can do everything from providing balance information to helping customers pay bills, make transfers, and even helping customers apply for new credit cards.

At the same time, if they can’t answer a question, they can route customers to the right place.

Financial institutions also leverage this technology to enhance their services. For instance, customers seeking assistance with a financial aid appeal letter can receive guidance from AI-powered chatbots. These virtual assistants can provide valuable information, help navigate the appeal process, and offer resources to increase the chances of a successful appeal.

Banks may also implement machine learning with their chatbots. This could help the bot learn individual customer behavior and get better at addressing their needs in the future. The bank may be able to trim down its customer service force and reinvest in other things.

Lastly, AI can play a role in underwriting loan products. It can potentially analyze borrower information much faster and reduce error. Plus, it can help remove human bias from the equation for a more inclusive lending process.

Investing/wealth management

Chatbots can play a similar role in investing/wealth management as they do in banking in terms of customer support. Chatbots for fintech can assist with tasks such as portfolio management, providing investment recommendations, and answering customer questions, allowing financial institutions to improve customer service and automate routine tasks.

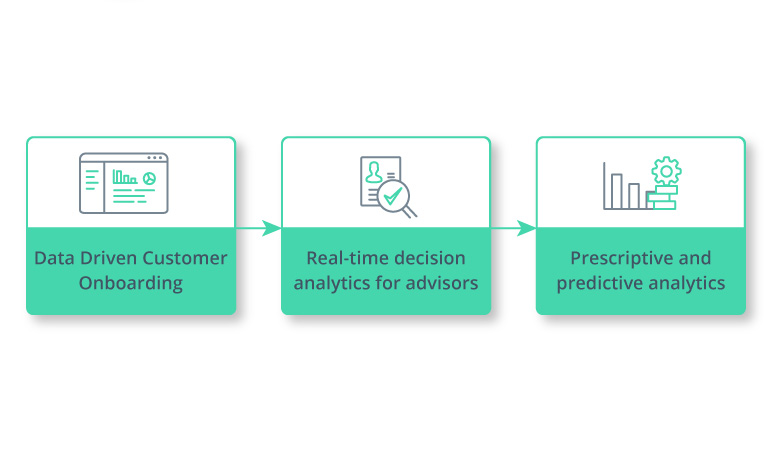

However, advisors and wealth managers could use AI and machine learning to make better investing decisions. With the advancement in fintech trends, AI technology can now rapidly analyze extensive datasets, enabling you to generate predictions based on diverse market scenarios and estimate prospective returns.

Similarly, you can use AI to automatically rebalance client portfolios. This reduces potential errors and saves time.

AI could also be used to gather new client information and then suggest portfolios to them based on their financial situation and goals. The advisor/wealth manager could step back a little and verify the AI is making the right recommendations without doing as much client onboarding themselves.

Real estate

AI can enhance the buying experience for home buyers by streamlining the home search. Real estate professionals can just plug a client’s information into the AI program, and it’ll return a bunch of properties that fit what the buyer wants.

Similarly, AI and machine learning can help streamline much of the buying process.

These technologies can also play a large role in lead generation for agents. They can analyze several data points to find likely buyers that also fit the agent’s preferred client profile.

Insurance

AI can assist insurance agents in finding the policies that more closely fit a client’s needs, especially when integrated into an insurance app development framework.

As for insurers themselves, they can use AI in generating leads and evaluating a potential customer’s risk — helping to provide a more accurate quote to each prospect with less time and effort.

When a customer files a claim, AI can be used to analyze the alleged events relevant to the claim and speed up the claims process. Machine learning can then be used to study and learn from datasets to identify potential insurance fraud as well.

2. Blockchain

Blockchain is a type of distributed, shared, public ledger. It primarily makes transactions faster, simpler, and more secure.

Right now, it’s most known for its connection to crypto. However, it’ll see plenty of use in many subsectors across finance. With the growth of various blockchain technologies, the need of blockchain advertising will also increase for business growth and promotion.

Banking

You may have to get familiar with the basics of blockchain because it offers plenty of benefits to banks, such as increasing transaction security while decreasing fees.

It can also enhance the security of loan applications. Currently, a bank may centralize all this information, making it vulnerable to hackers. However, you may start using blockchain at some point to speed up the process while making things more secure.

Investing/wealth management

Blockchain is certain to streamline trading and investing by reducing the need to rely on numerous third parties to process the transaction. This makes it cheaper and faster for you to execute trades for clients, which is sure to increase their satisfaction with your services.

Also, blockchain might be a sector of interest for some clients. They may want to invest in blockchain stocks, crypto stocks, or cryptocurrencies, crypto bot. Profit from cryptocurrency attracts taxes. It is super important to be aware of crypto taxes.

Additionally, some clients may be interested in using a specific brokerage service that offers a range of investment options, including cryptocurrencies and blockchain-related assets. For example, the SoFi brokerage allows users to invest in a variety of traditional and alternative assets, including stocks, ETFs, and cryptocurrencies.

Real estate

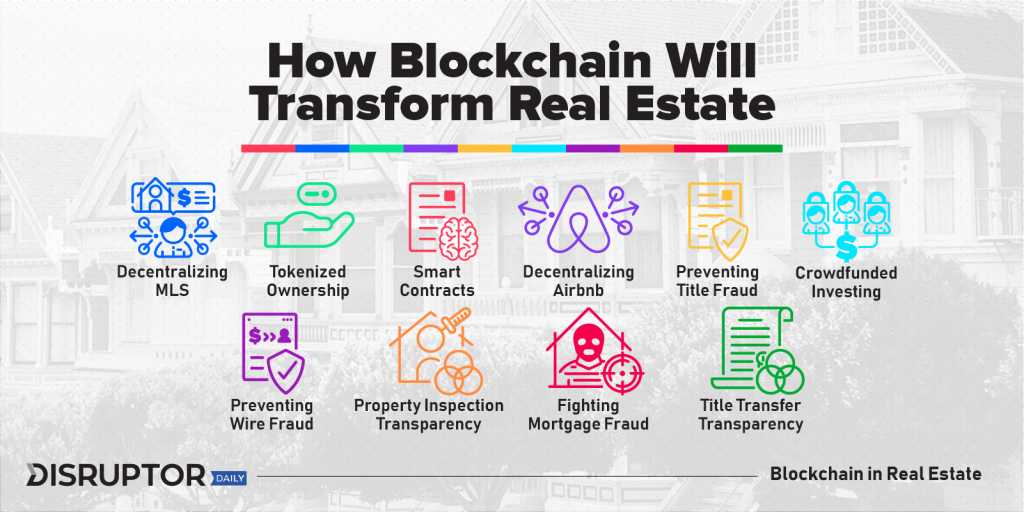

Blockchain can cut out or reduce reliance on many of the intermediary parties involved in real estate transactions.

As a result, Blockchain may actually reduce the need for some potential clients to use agents for certain parts of the process. This makes the process much quicker, allowing you to potentially do more deals.

However, clients may need you for fewer parts of the process. You’ll need to find new ways to market your services, raise brand awareness, and focus on providing top-notch customer service to your clients. Investing in other technologies mentioned on this list can help with that.

Blockchain could also make real estate investing more accessible to the average investor through tokens and fractional ownership. This could expand opportunities for property management companies.

Insurance

Blockchain will help foster trust between insurers and policyholders, as smart contracts will allow for better info verification and help reduce potential insurance fraud.

Health insurance, in particular, could see a huge increase in blockchain use because of its decentralized and secure nature. You may be able to gather customer health records directly on the blockchain when they apply, speeding up the process and making the customer feel more at ease with what happens to their health information.

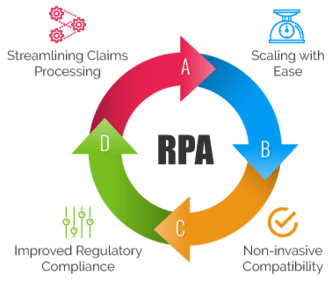

3. Robotic process automation

Robotic process automation is similar to AI but less advanced. It uses a fixed set of rules to automate simple manual processes such as data entry and certain aspects of marketing.

It’s already seeing widespread use across the finance industry — especially for internal tasks — and will only grow in importance in the future.

Banking

RPA is a great tool for automating appointment scheduling and notifications regarding those appointments.

Banks can implement RPA to send out automated account notifications to customers when they make deposits, transfers, hit a certain balance, and more.

Plus, you can use automation for a host of internal tasks, such as data entry and report generation. It’ll help improve compliance and reduce human error that can happen during these manual tasks.

If you don’t have an AI chatbot, you could at least implement an RPA bot that can handle simpler tasks without human-level conversational abilities. This could offload some of the more basic customer service tasks, like checking bank balances.

RPA can also be used for calculation of taxes. For instance, RPA-driven crypto tax software could help automate calculation of crypto taxes by taking certain inputs from the user.

Investing/wealth management

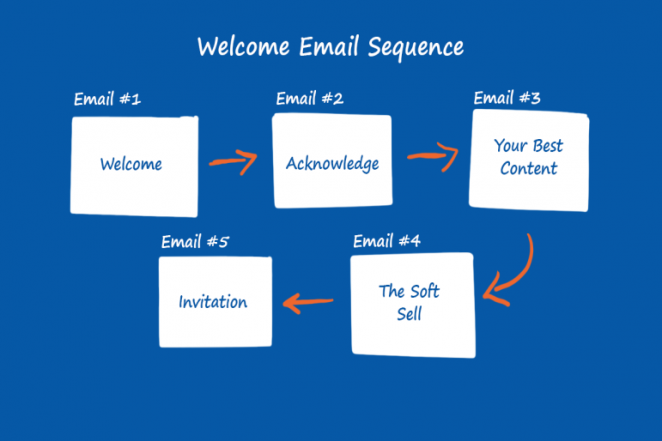

Advisors can market their services much more efficiently with RPA. Build an email list and set up some sequences, and you’ll keep clients and prospects engaged and educated with less time investment.

RPA is also useful for scheduling and notifying clients of their appointments and sending out trade confirmations.

Once again, as in most industries, simple automations are also helpful for your back-office tasks like accounting and administrative matters.

Overall, advisors may be able to expand their lead generation efforts and take on more clients without overbooking themselves and will potentially deliver better results, too.

Real estate

Landlords will find RPA particularly useful in handling repetitive but critical tasks like tenant onboarding and payment collection.

RPA can help gather and verify applicant information, run background checks, and assist with approval decisions.

Landlords can use RPA to set up payment notifications via email for current tenants. This can lift a huge burden off landlords, as collecting payment is a repetitive and sometimes draining task.

Real estate agents can use RPA when looking at new leads. Once they gather the lead’s information, RPA could route that to a robust CRM for real estate without the agent having to worry about it.

All that said, RPA is a fantastic marketing tool for anyone working in real estate. Landlords, agents, developers, and so on can implement automated marketing through email and ads to generate leads while freeing up time for other activities.

Insurance

The most apparent use case for RPA in insurance is gathering claims information. A little bit of RPA can handle data gathering and document processing with fewer human errors to ensure claims are handled properly and compliantly.

Marketing is another great use case for insurance RPA. For instance, you could write upsell or cross-selling sequences that persuade an auto policyholder to get a homeowner’s policy and bundle it with their auto policy.

With some simple rule-setting, you could have this email sequence trigger after a certain timeframe to ensure the customer is satisfied with one policy to improve your chance of closing the sale.

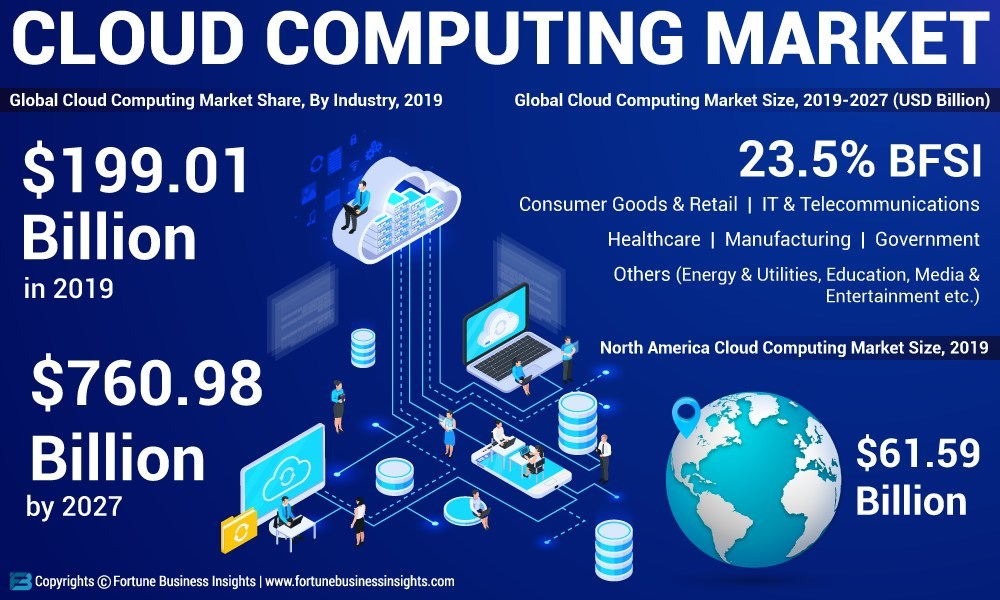

4. Cloud computing

Cloud computing involves delivering computing services over the Internet without the user needing to set up and manage their own on-site data centers.

It gives financial firms virtually unlimited storage capacity to deal with their vast quantities of data, increases security, cuts costs, and provides access to a larger pool of job candidates. Similarly, it offers you more career opportunities and capabilities on the job.

Banking

The biggest effect cloud computing will have on your day-to-day is the ability to work from anywhere — whether that’s work tasks or calls/meetings.

Similarly, cloud computing expands your job prospects immensely. For instance, you can work for a bank in a different state without much of a problem.

As for banks themselves, cloud computing helps with backups, business continuity, and disaster recovery. This helps deliver a better customer experience and minimizes interruptions to your work if something goes down.

Investing/wealth management

Again, cloud technology allows advisors to serve their clients well from nearly anywhere. Some clients will prefer face-to-face interaction, but many may be able to meet over a video call. Your clients may also reach you or manage their relationship with you via a mobile app.

You can cut your costs and optimize efficiency because you pay as you go for cloud-based software. You can handle client acquisition, marketing, invoicing, and more with cloud applications — making it entirely possible to run your full advising or wealth management business without much more than a computer.

Plus, the company from which you buy the software handles all the software maintenance for you.

Real estate

Agents are frequently on the move, so working in the cloud can drastically improve your productivity.

Cloud computing in real estate has moved more of the home buying process online. That may mean less traveling for parts of the process your client may normally do in person.

Marketing is a huge area where agents can benefit from cloud computing. The cloud makes it simple to create and manage your campaigns and leads from anywhere through CRMs, email marketing software, and more.

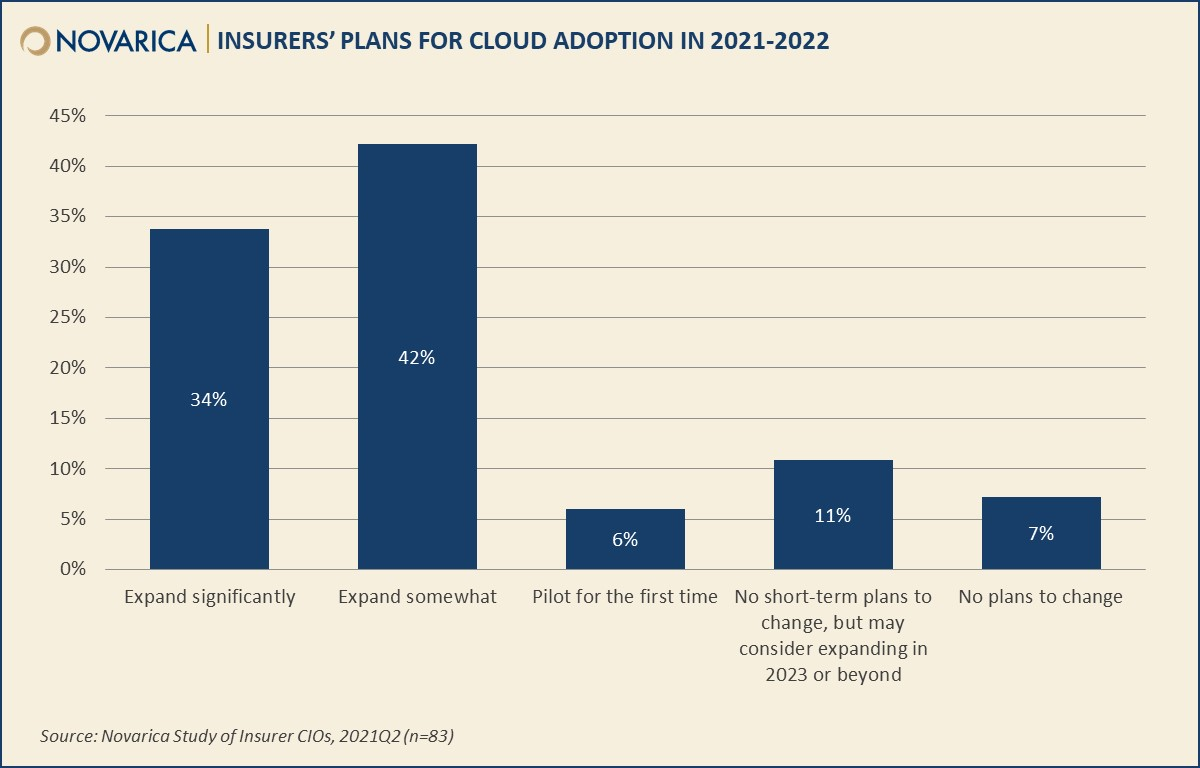

Insurance

Once again, professionals across the insurance agency will be able to work from anywhere with cloud computing.

Insurance agents could potentially run an entire business from their laptop. Meanwhile, insurance companies could distribute their teams remotely and cut costs, which could give you more lifestyle flexibility as an employee.

You’ll also use more cloud applications for collecting data for claims, processing and paying out those claims, marketing to potential customers, and more.

5. Augmented and virtual reality

Augmented reality involves overlaying computer-generated visual and auditory elements onto reality — usually using a smartphone app or headset.

Virtual reality takes things a step further. It uses computer technology to create a completely digital simulated world that could be similar to or entirely different from the real world.

Both technologies will have a significant impact on the financial sector because of their data visualization capabilities. In fact, we’re already seeing some of these today.

Banking

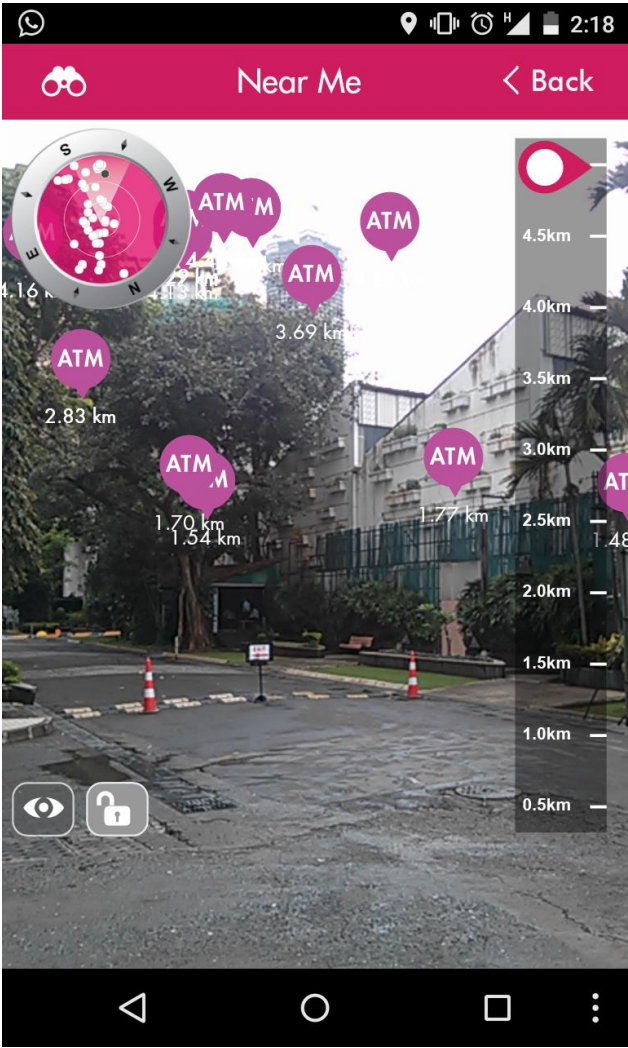

Some banks are implementing AR to help customers find bank and ATM Locations. For instance, India’s Axis Bank has a smartphone app that uses AR to place arrows on the screen pointing toward the nearest ATM or branch.

Such an app could result in fewer customers calling the bank asking for hours, location, and so on — leaving more time for bank employees to serve customers in the branch and work on other things.

VR offers exciting prospects as well. It can help you educate your customers on the products and services you offer by providing an immersive virtual environment. In fact, you’re better able to teach them about “boring” matters, like regulations that impact their accounts, with VR.

You might even be able to guide them through the virtual bank environment remotely, letting you help customers without needing them to visit the branch.

Investing/wealth management

Financial advisors and wealth managers can use AR and VR to improve their performance and increase client knowledge and satisfaction.

On the client-side, you can use AR and VR to show clients how various economic or market scenarios, such as a market crash, could impact their portfolios. They’ll have a much better image than if you just explained it to them. As a result, they’ll feel more confident placing their wealth in your hands.

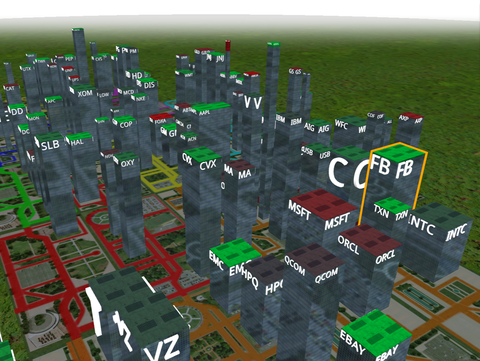

In fact, Fidelity did this years ago through Fidelity Labs, its fintech incubator arm, by creating its 3D StockCity market simulation with an Oculus Rift VR headset.

Using the same AR and VR tech, you get far more data with which to project potential returns based on simulated portfolio allocations and potential market scenarios. In theory, you could help your client earn better returns and spend less time doing it.

Real estate

Real estate agents can simplify the house hunting and buying process for their clients with AR. For instance, you could have an app created that lets clients scan houses in real life.

The app would then provide information about the property if it’s on the market, such as price, time on the market, and other info about the home itself.

AR and VR apps could also help stage homes virtually. This gives you nearly unlimited options for staging a house without necessarily needing to pay for the services.

This makes it easier to tailor a staging to each buyer, making the property more attractive to a wide array of buyers — which ultimately makes you more attractive to home sellers.

Lastly, property developers can use this tech to create digital models of homes, saving an untold amount of time building and tweaking the model.

Insurance

AR, in particular, can help provide more accurate quotes to potential policyholders. Inspectors could use a smartphone to look for potential problems in pieces of property before insuring them, ultimately helping the underwriter.

The claims process could use AR in a similar manner. The adjuster can use the AR app to locate damage to the property, especially if they need to access hidden areas, such as behind walls in a home.

An adjuster may not even need to visit the property in some situations. The policyholder could use the app to show the damage, and the adjuster could remotely use AR on a computer to take measurements and evaluate claims.

This could accelerate the claims process while improving customer satisfaction.

Get Ready for these Emerging Technologies in the Workplace

By implementing AI, machine learning, automation, and blockchain, the financial professional of the future will have far more time and energy to dedicate to building stronger customer relationships.

Then, using AR, VR, and digital experience platforms, financial institutions can empower their employees to enhance the customer experience and strengthen those relationships.

Investing some time in learning these new technologies will help financial professionals continue to advance their careers as more firms begin to implement them.